North American Markets: Seizing Opportunities in Volatility

North American financial markets reflect a tale of resilience and divergence. The US economy shows strength in earnings and jobs but faces tariff-driven stagflation risks. In the Eurozone, GDP grew by 0.3% in Q1 2025, supported by increased consumer spending in Germany and France, though persistent 2.4% inflation limits expectations for European Central Bank rate cuts. Gold’s record highs above $3,400 and robust junior resource activity signal opportunity. However, volatility from tariffs, coupled with growing market optimism due to signals of trade negotiations with China, demands cautious and reliable trading strategies.

Corporate Earnings: Strong Q1, Cloudy Outlook

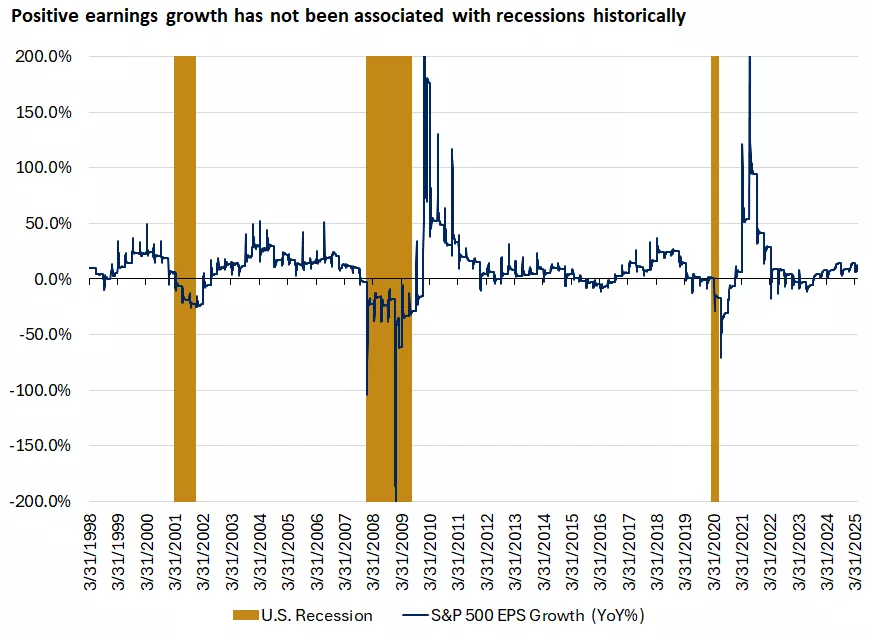

First-quarter earnings for S&P 500 companies exceeded expectations, with 76% reporting positive surprises, surpassing the 10-year average of 75%. Year-over-year earnings growth reached 12.5%, outpacing the forecasted 11.5%. Microsoft reported record revenues of $70.1 billion and earnings per share of $3.46, beating estimates ($68.4 billion and $3.22), driven by a 21% surge in Azure cloud services, making it the world’s most valuable company, surpassing Apple. Meta achieved revenues of $42.3 billion and earnings per share of $6.43, surpassing forecasts ($41.4 billion and $5.23), with 3.43 billion daily users boosting ad growth. Both raised Q2 guidance, pushing shares up 10% and 7%, respectively.

Source: Bloomberg

Amazon posted revenues of $155.67 billion and earnings per share of $1.59, supported by Amazon Web Services ($29.3 billion) and advertising ($13.92 billion), achieving a record Q1 operating margin of 11.8%. However, weak Q2 guidance reflects tariff concerns, with President Donald Trump’s 145% tariffs on Chinese imports threatening 11% of Meta’s ad revenues from China and Microsoft’s $80 billion AI hardware costs. In Canada, Franco-Nevada hit $239.73, and Lumina Gold soared 28.89% after a takeover. Earnings growth for 2025 is projected at 9.5%.

Economic Growth: Temporary Dip, Not a Recession

US GDP growth turned negative in the first quarter, declining by 0.3% against expectations of a 0.2% drop, driven by a surge in imports as firms anticipated higher tariffs. Yet, personal consumption rose 1.8%, and business investment surged 21.9%, reflecting resilience. The import spike is expected to reverse in Q2, likely returning GDP to positive territory. Assuming tariffs remain moderate (around 10% with key partners), GDP growth for 2025 is projected at 1.5%, down from 2.8% in 2024. A worst-case scenario with sustained high tariffs could push the economy toward a mild recession, though Federal Reserve rate cuts could mitigate this risk.

Jobs Market: Resilient but Vulnerable

The labour market remains a pillar of strength. April’s nonfarm payrolls added 177,000 jobs, exceeding forecasts of 130,000, after a downwardly revised 185,000 in March. The unemployment rate held steady at 4.2%, reflecting a stable labour market. However, the report does not fully capture the impact of tariffs imposed on April 2, and economists expect job growth to slow in coming months as tariff-related layoffs rise. Wage growth, at 3.8% annually, continues to outpace inflation, supporting consumer spending. The jobs report allows the Federal Reserve to adopt a more patient approach to rate cuts in 2025, with markets now expecting three cuts in the second half of the year, down from four. Federal Reserve Chair Jerome Powell is likely to maintain rates at 4.25%–4.50% on May 6-7, balancing tariff-driven inflation and growth slowdown risks. The Bank of Japan kept rates steady at 0.5%, cutting 2025 growth forecasts to 0.4%–0.6% due to US tariff impacts.

Gold: Challenges for the Safe Haven

Gold prices fell to $3,225 on Friday before settling at $3,240, down 2% weekly, despite GDP contraction. Investors leaned toward the US dollar and government bonds, reflecting gold’s saturation after hitting $3,500. Gold holds support at $3,200, but dollar strength and cautious Bank of Japan forecasts limit gains. Tariff fears, particularly with signals of trade talks with China, could revive gold’s safe-haven appeal.

Oil: Demand Concerns Persist

Brent crude fell to $61.00 (-0.1%) and West Texas Intermediate to $58.09 (-0.2%), with weekly losses of 5–7%. Saudi Arabia’s tolerance for lower prices and OPEC+ plans to boost output on May 5 pressure prices. Despite a 2.7-million-barrel drop in US oil inventories, experts cut 2025 global demand growth forecasts to 640,000 barrels per day, with Brent expected to rise to $68.98, reflecting US GDP contraction and tariff risks.

Cryptocurrencies: Bitcoin Stabilizes

Bitcoin stabilized at $94,943.4, up 20% in April but flat recently as ETF inflows slowed, with $56.2 million in outflows on Wednesday. Donald Trump’s tariff escalation with China dampens risk appetite, but a 90-day tariff delay for some allies and China’s signals of openness to negotiations support market sentiment. Bitcoin’s long-term potential persists if tariffs weaken the dollar, though short-term macro headwinds limit gains.

Sterling Under Pressure

The GBP/USD pair fell to 1.3295 (-0.25%), driven by weak UK manufacturing (PMI at 50.2) and expectations of Bank of England rate cuts under Governor Andrew Bailey. The US dollar fell on Friday after the jobs report but trimmed losses against the euro and yen, supported by optimism over tariff deals with trading partners. Support at 1.3250 is critical amid ongoing tariff talks.

Looking Ahead: Navigating Volatility

The S&P 500 has rebounded 8% over the past two weeks, buoyed by strong Q1 data and optimism over potential trade deals, particularly with China addressing the Trump administration’s fentanyl trade concerns. However, activity data may appear strong for a few months due to front-loading, with spending drops and rising layoffs expected by summer. Sectors like financials and healthcare, less exposed to trade risks, offer stability, while bonds with seven- to 10-year maturities present value if rates fall. Progress on trade deals, Fed rate cuts, and policy reforms could pave the way for improved market sentiment in 2026. Investors should diversify into technology and resources, balancing caution with high-return opportunities.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations