Last week, risk assets and gold emerged as the clear winners over the dollar in the financial markets race. This was fueled by recent economic data releases from the United States, which reinforced the perception of price stability and strengthened the likelihood of continued interest rate cuts by the Federal Reserve in the same pace of September cut.

Key economic indicators – GDP and Personal Consumption Expenditure (PCE) – painted a positive picture of the US economy. These data points suggested that the Fed may maintain its current trajectory of easing monetary policy, a move that typically benefits risk assets like stocks and commodities.

US dollar closed last week’s trading lower as U.S. Dollar Index (DXY) finished in the downside at , rose to 100.42 points, compared to the previous week’s close of 100.76. The index reached a high of 101.08 during the week’s trading, compared to a low of 100.21.

On the other hand, Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite added approximately 180 points, 20 points, and 114 points, respectively, for the week ended on 27 of September.

Economic data

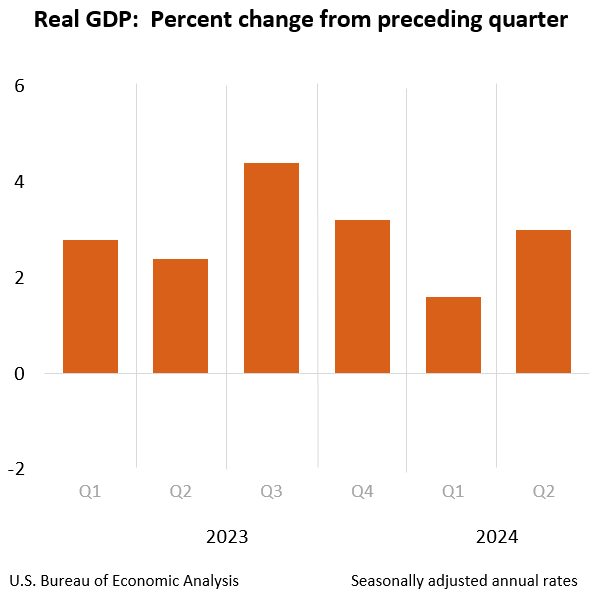

The US economy maintained a steady growth pace in the second quarter of 2024, with real Gross Domestic Product (GDP) expanding at an annual rate of 3.0%, according to the final estimate released last Thursday.

In the first quarter, GDP increased 1.6 percent (revised). The second-quarter increase in real GDP was the same as previously estimated in the “second” estimate released in August.

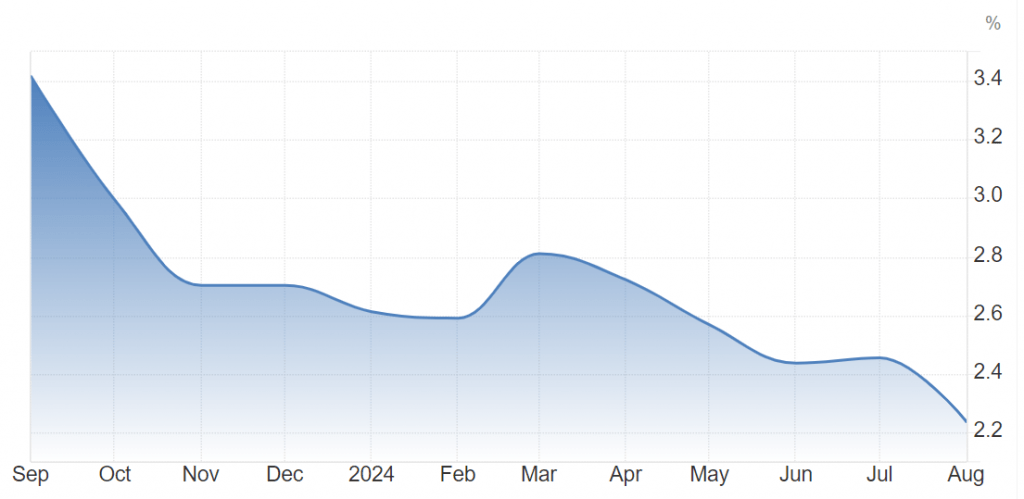

Inflation in the United States continued to show signs of moderation in August. The Personal Consumption Expenditures (PCE) price index, a key measure of inflation, increased by only 0.1% compared to the previous month. This marks a slowdown from the 0.2% gain recorded in July.

On annual basis, PCE eased to 2.2%, down from 2.5% in July, according to the annua reading. This suggests that inflationary pressures are gradually easing in the US economy.

Fed’s statements

Federal Reserve Bank of Chicago President Austan Goolsbee indicated last Monday that he anticipates multiple interest rate cuts over the coming year. This stance aligns with the Fed’s goal of achieving a “soft landing” for the US economy, which involves curbing inflation without causing significant job losses or economic contraction.

Goolsbee also noted that inflation has significantly declined from its peak and has recently been converging with the Federal Reserve’s target of 2%. This positive development is a key factor influencing the central bank’s decision to ease monetary policy.

He added: “Basically, we would love to freeze both sides of the Fed’s dual mandate right here,” Goolsbee said. “Yet rates are the highest they’ve been in decades. It makes sense to hold rates like this when you want to cool the economy, not when you want things to stay where they are”.

He also said: “I am comfortable with a starting move like this — the 50 basis point cut in the federal funds rate announced last Wednesday — as a demarcation that we are back to thinking more about both sides of the mandate,” Goolsbee said on Monday. “If we want a soft landing, we can’t be behind the curve”.

China Stimulus announcement

The package includes – among other measures – a rate cut by 30 bps and lowering reserves requirements for banks by 50 bps to boost stock markets, support bank capitalization, and provide mortgage relief.

Chinese stocks staged a recovery by 15% last week. Although starting from relatively low levels, this rally is a positive sign for the country’s economy.

Shanghai Composite Index closed last week’s trading higher at 3087 points, compared to the previous week’s close of 2746 points. The index reached a low of 2735 points during last week’s trading, compared to a high of 3088 points.

Cryptocurrencies

Cryptocurrencies staged a strong rebound last week, driven by supply and demand dynamics, the correlation with US stocks, and inflows into crypto exchange-traded funds (ETFs).

However, crypto market’s gains were tempered by two negative developments. First, headlines highlighted the upcoming unlocking of over $600 million worth of crypto tokens within the next two weeks, which could potentially put downward pressure on prices. Second, BlackRock, a major financial firm, filed an amendment to reduce the withdrawal time for its spot Bitcoin ETF, raising concerns about potential selling pressure.

On the other hand, bitcoin and other major digital currencies made profits after gathering upside momentum by news of continuous increase in spot bitcoin EFTs.

Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite added approximately 180 points, 20 points, and 114 points, respectively, for the week ended on 27 of September, which provided a boost for cryptos due to the positive correlation between bitcoin and indexes of New York Stock Exchange.

Bitcoin exchange-traded funds (ETFs) continued to attract significant inflows, with daily net inflows exceeding $100 million for the second consecutive day, according to SoSoValue data. This marks five consecutive days of positive net inflows for these funds.

Furthermore, an analysis of 30-day net holdings by CryptoQuant revealed a positive trend for the first time in September. This shift from a selling trend to an accumulating trend suggests growing investor confidence and a potential upward trajectory for Bitcoin prices.

Next week forecasts

Next week, economic data releases will be a major driver of market sentiment, with particular focus on developments in the United States, Europe, and the global economy.

US employment data is expected to be the most closely watched indicator, as it will significantly influence expectations for Federal Reserve interest rate policy. Inflation data from Germany, the largest Eurozone economy, and broader Eurozone inflation figures will also be closely monitored. Additionally, the UK’s growth data will be a key focus, drawing attention to the European economic landscape.

Throughout the week, US initial jobless claims data will be released, culminating in the most crucial report at the end of the week. This report will provide a clear assessment of the US labor market and offer valuable insights into the potential trajectory of interest rates.

A series of US economic indicators will also be released, shedding light on the health of the manufacturing and services sectors. These data points will contribute to a comprehensive understanding of the overall US economic condition.

Federal Reserve governors are scheduled to make statements during the week, providing further clarity on the current stance of monetary policy and the central bank’s evaluation of the US economic outlook.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations