Investors and traders kept a close eye on the US inflation figures as well as the FOMC meeting in June. Due to the Fed’s aggressive approach, selling transactions took hold of gold prices immediately following the announcement that US interest rates would remain steady.

Prior to the announcement of the most recent US inflation figures, investors exhibited a certain amount of caution. The US Central Bank indicates that an average of one interest rate cut is anticipated this year. The euro-US dollar pair also increased over the 1.08 level, and although the price of gold stayed close to $2,315 per ounce, it finished the week’s trading above that mark on Friday. An ounce costs $2,329.

US Interest Rate Decision

The FOMC decided to maintain interest rates within the 5.25-5.50% range, aligning with market expectations. The committee emphasized the need for further assurances that inflation will return to target levels before considering rate cuts.

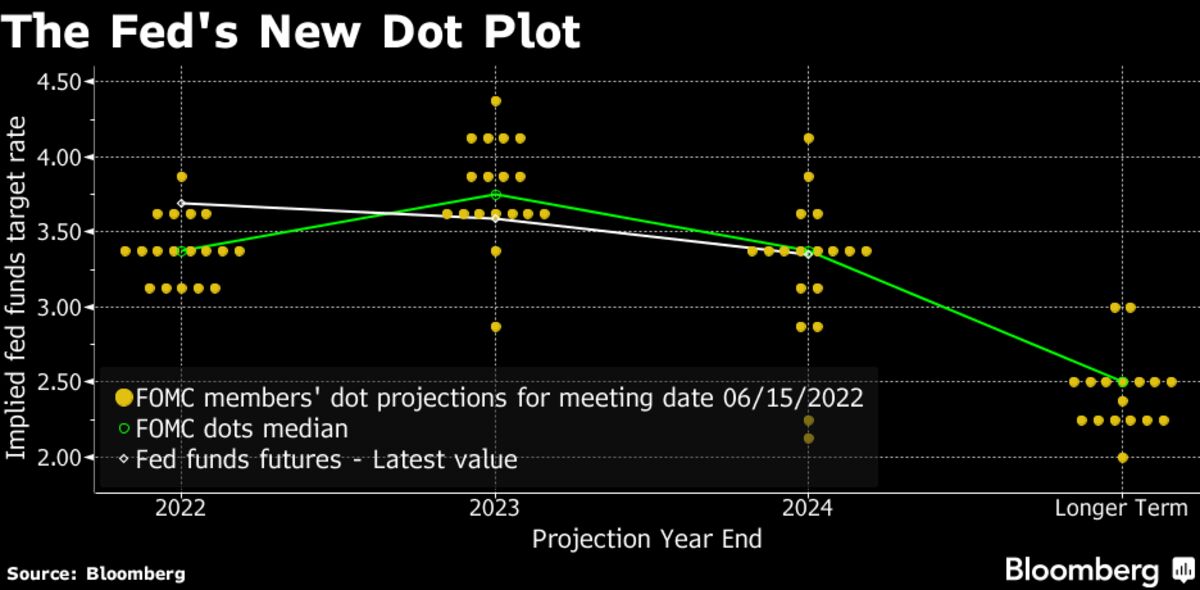

The latest “Dot Plot” revealed an average expectation of just one rate cut in the current year, a shift from the three cuts anticipated in March. Members were almost evenly divided between expecting a first and second cut in 2024.

Despite current inflation expectations and increased inflation projections from the Fed, Wall Street reached new highs. Investors still anticipate two rate cuts in 2024, with a 70% chance of the first cut occurring in September. The Fed now plans to cut interest rates four times in 2025, down from the three expected in March.

Bank of Japan, Asian, and European Markets

Investor sentiment in Asian markets weakened ahead of the Bank of Japan’s interest rate announcement. The Japanese yen declined, and the euro faced political tensions in Europe. The Bank of Japan maintained interest rates but signaled plans to reduce bond purchases. Meanwhile, the euro traded at $1.07355, reflecting concerns about political stability in the region.

Bond Market and US Inflation Data

10-year Treasury yields rose to 4.325%, showing high volatility as traders adjusted their positions. Headline US CPI inflation for May surprised observers by declining to 3.3% year-on-year, below expectations and last month’s reading of 3.4%. This moderation in inflation was positive news for investors after a series of hotter inflation reports earlier in the year.

Central bank decisions and inflation trends continue to shape global markets, with investors closely monitoring economic data and policy shifts.

US Inflation Data

Headline US CPI inflation for May surprised observers, declining to 3.3% year-on-year—below expectations and last month’s reading of 3.4%. After a series of hotter inflation reports in the first quarter of the year, this moderation came as good news for investors.

Core Inflation

Excluding food and energy, core inflation stood at 3.4% in May, slightly below expectations. This suggests that fundamental price pressures are not accelerating as rapidly as previously feared.

Fed’s Stance

During the June meeting, the Fed maintained benchmark interest rates within the 5.25%-5.5% range, as anticipated. However, their updated forecast now calls for just one rate cut in 2024, down from the three cuts expected in March.

Looking ahead, the Fed’s long-term view remains steady. The federal funds rate is still projected to reach 3.1% by 2026, consistent with their March forecast.

Bank of Canada’s Move

In contrast to the Fed, the Bank of Canada decided to cut interest rates by 0.25%, bringing the rate down from 5.0% to 4.75%. This decision reflects Canada’s more favorable inflation trajectory and weaker economic growth. Canadian GDP growth is expected to be only 1.0% per year, compared to the US forecast of 2.4% GDP growth.

The Bank of Canada is likely to continue a gradual path of rate cuts alongside the Fed, implementing one or two more rate cuts in 2024.

Inflation Drivers

Fed Chairman Jerome Powell highlighted potential factors that could push inflation lower in both the United States and Canada. These include a moderation in the housing and rent components of the CPI basket, as well as a cooling of services inflation as the labor market stabilizes and wage growth slows.

Recent economic data revealed an increase in new applications for unemployment benefits to a 10-month high, while other indicators pointed to an unexpected drop in producer prices in May. These developments raise expectations that the Fed may initiate a monetary easing cycle in September.

Disinflation Path

While inflation is unlikely to decline in a straight line, the disinflation path is expected to continue in the coming months. This trajectory would give the Fed and Bank of Canada greater confidence to implement further adjustments to interest rates.

The Week Ahead

Next Tuesday, June 18, markets will closely follow the Australian interest rate decision, US retail sales data for May, and US industrial production data.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations