Last week’s trading closed in favour of global stocks and the US dollar at the expense of gold, amid data-based support to the idea that it is possible for the Fed to achieve the “soft landing” scenario, which was evident through US economic data that the economic calendar carried to the markets in the trading week ending on January 26, 2023.

The Euro, as well as the Canadian dollar, had different stories over the past week, with the European Central Bank and the Bank of Canada keeping interest rates unchanged and maintaining a negative rhetoric regarding the future path of the economy in the Eurozone and Canada.

Gold incurred its second weekly loss on the significant US dollar’s surge after key US economic data that sparked some optimism across financial markets.

There were several factors that pushed oil futures contracts in the direction of achieving significant weekly gains after rising by about 7.00% for the week.

Economic Data

The US GDP Price Index recorded an increase of 1.5% in 2023’s Q4, which was lower than the reading recorded in the third quarter of 2023.

Although the actual reading was lower than the previous one, it confirms that the US economy is still within the positive growth zone and that it was able to avoid contraction by yearend.

The weekly Jobless Claims recorded an increase of 214,000 in the week ending January 19, compared to the previous reading, which recorded 189,000; namely higher than market estimates that indicated only 200,000.

The total number of beneficiaries of jobless benefits in the United States also rose to 1.833 million in the week ending January 12, compared to the previous reading, which recorded 1.806 million, exceeding market expectations that indicated 1.828 million.

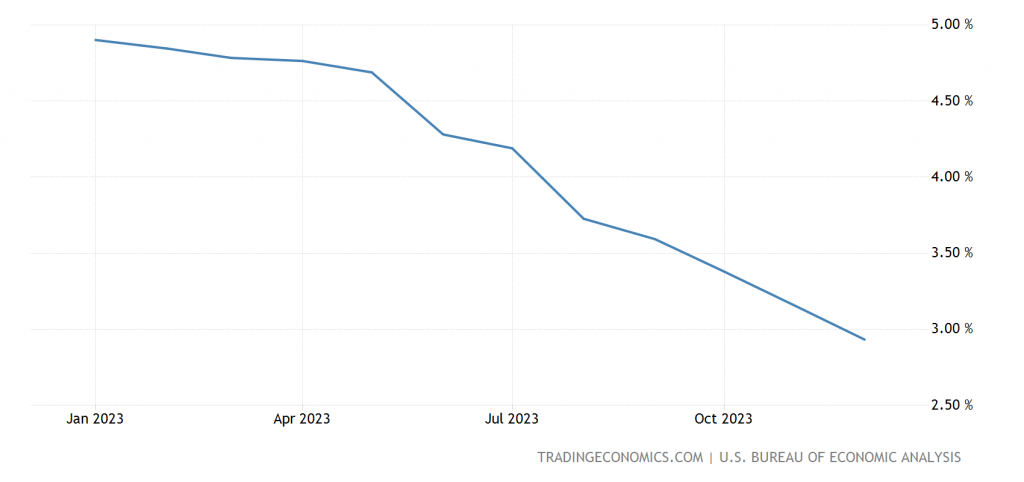

Mostly important was the US inflation data, as the reading of Personal Consumption Expenditure, Fed’s favourite inflation gauge, recorded 1.7% in the last quarter of last year compared to the previous reading that recorded an increase of 2.6%.

The Core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The reading of the personal consumption expenditures index, excluding food and energy prices, in 2023’s Q$ witnessed no change, remaining stable at 2.00%, and came in line with expectations.

This data raised speculation that the Federal Reserve will not be in a rush upon considering when to start to cut interest rates, as it appears to be close to achieving the “soft landing” scenario, which includes achieving the goal of reducing inflation to target level without pushing the US economy into a recession.

Global stocks and the US dollar

The Dollar Index, DXY, which measures the performance of the US currency against a basket of major currencies, closed the trading week in an upward trend, benefiting from recent data that increased confidence in the performance of the economy in the United States in the recent period.

The US dollar’s rise relied on its position as the currency of the world’s largest economy, which has recently achieved strong performance. The US dollar has gained many points in the past few months.

The most influential data on the US dollar was the growth data, which was focused on by dollar bulls who saw that the US economy’s continued growth is evidence that the Fed is moving steadily towards achieving its most important goal at the current stage, which is reducing inflation. The recent data also avails the central bank the opportunity not rush to cut interest rates.

Wall Street also benefited from the strong bets on “soft landing” scenario, which includes the possibility of the Federal Reserve succeeding in reducing interest rates without sending the US economy into a recession.

The Dow Jones Industrial Average rose by about 0.2%, while the S&P 500 and the Nasdaq Heavy Technology Index lost less than 0.1% and 0.4%, respectively.

Euro, CAD

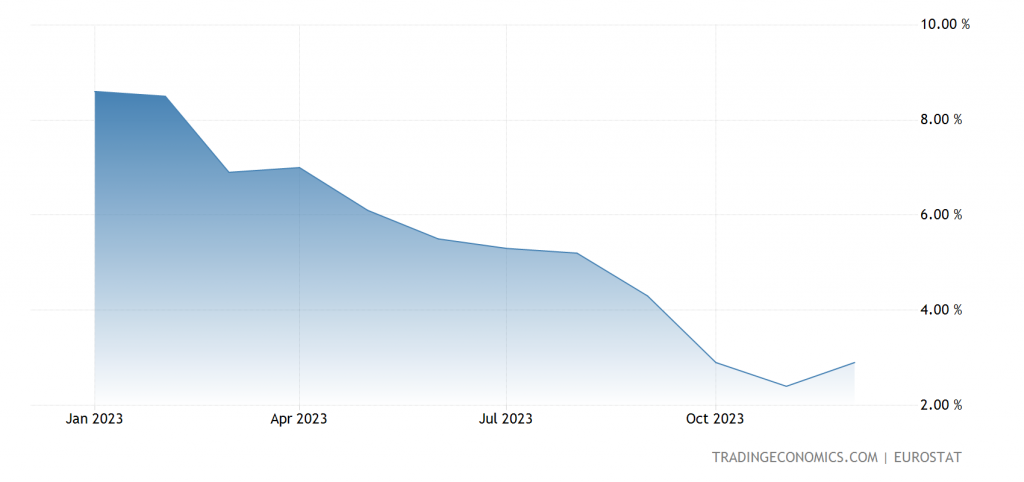

The euro had a different story last week, the shared currency ended last week’s trading in a bearish direction despite the European Central Bank keeping interest rates unchanged at its January meeting and despite the central bank’s tendency to downplay bets that the ECB was closer to starting to reduce interest rates.

Despite European interest rates continue at historic high levels and the ECB is seen as favouring to keep these high rates unchanged in the coming period, the European currency was unable to benefit from this stance, in terms of price action.

The Euro’s weekly losses came as a result of a large amount of negativity spread across the market following the remarks by Christine Lagarde, Chair of the Board of Governors of the European Central Bank, who spoke about the future path of the economy in the Eurozone and its relationship to the interest rate decision in the next stage.

Lagarde said, in the press conference held after the announcement of the decision to stabilize European rates: “Geopolitical tensions in the Middle East increase the risks of an increase in inflation.”

Lagarde added: “Inflation may decline more quickly if energy prices develop in line with the recent decline,” but stressed that “there was a consensus at the meeting that it is too early to talk about lowering interest rates.”

Lagarde expected that looming data could show that the Eurozone’s growth ceased in the fourth quarter of last year, suggesting that a series of PMIs reflected that there are some signs of recovery that may be reflected on the economic performance soon.

The Canadian dollar had a similar story, as it declined despite keeping the Canadian interest rate unchanged, due to the dovish stance by the Bank of Canada.

Eurozone Annual CPI December 2023 – Source: Tradingeconomics

Crude Oil

Oil futures concluded last week’s trading with significant gains amounting to about 0.7% after the sharp decline in US inventories, which could act as a sign sign of a recovery in energy demand in the world’s largest economies.

In addition, there are some factors related to risk trends in global financial markets, most notably the economic data that showed positive momentum on Thursday.

This data shed light on what favours the “soft landing” scenario, which includes the Fed succeeding in reducing inflation without the US economy entering a recession.

US oil inventories fell by 9.2 million barrels last week, according to the US Energy Information Administration, surpassing market estimates of a less severe decline of 2.2 million barrels.

The inventory report also indicated a decline in the rate of oil output in the United States from the highest record levels of 13.3 million barrels per day to the lowest levels in five months at 12.3 million barrels last week.

Officials at production sites in the US state of Dakota, the third largest oil producing state in the United States, said that it may take at least a month for production in the state’s oil fields to recover.

On the earnings front, as for earnings reports issued last week, Procter & Gamble’s profits for family products exceeded expectations in the second quarter of the fiscal year 2023, but the company’s revenues were slightly lower than what market expectations indicated. Johnson & Johnson’s household earnings also beat expectations, but not by much.

Next trading week

With five Big Tech companies reporting results between next Tuesday and Thursday, the S&P 500 Index is closing in on record territory this week. The Federal Reserve will announce its interest rate decision, and then Chair Jerome Powell will hold a press conference to discuss the future. With central bankers about to ease monetary policy and tech giants like Microsoft becoming more valued, the stakes are higher than ever.

In spite of a decline in Tesla’s stock that has erased more than $200 billion in market value in just one month, the Magnificent Seven, which includes the electric vehicle manufacturer, recently touched a record 29% of the S&P 500.

Microsoft and Alphabet will kick off earnings on Tuesday after markets close, as they are well positioned to benefit from the AI boom after investing heavily in the field for years. Investors are betting that AI will soon start boosting profit and sales growth.

The conclusion of the Fed’s January meeting, anticipated to keep interest rates unchanged for a fourth consecutive meeting, will take centre stage on Wednesday. What Powell and other authorities have to say about when to ease will be the main focus of traders.

The big attraction on Thursday is Apple, which reports in the afternoon along with Amazon and Facebook-owner Meta Platforms. The manufacturer of the iPhone is anticipated to report its first increase in sales in four quarters, but has been plagued by worries about revenue growth. Given that the majority of Megacaps are trading at record highs, there are worries that investors may be overexposed to a small number of firms, which may be problematic if quarterly results fall short of expectations.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations