Last week witnessed several important events and movements in terms of their impact on overall trading transactions. The week closed with a sharp decline in the US dollar in addition to weak performance of risk-linked assets amid mixed risk appetite due to the growing importance of the statements and data received by the markets throughout the trading week.

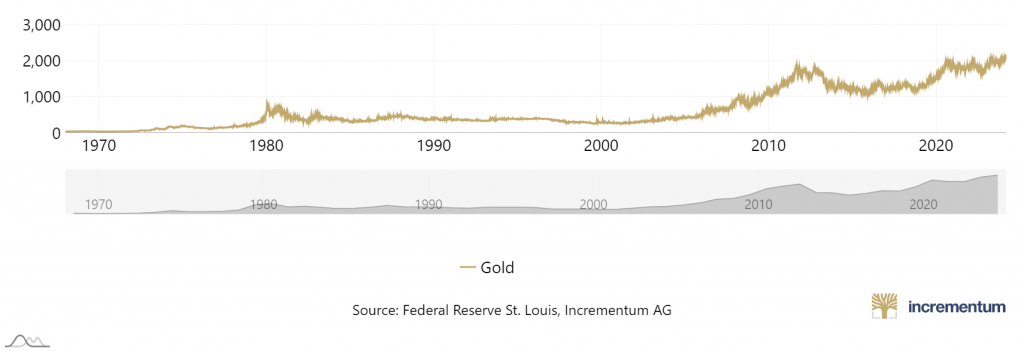

Gold was able to mater the scene by the end of last week, benefiting from the pressure on the US dollar because of rising expectations that the Federal Reserve could start cutting interest rates next June following statements by Fed Chair Jerome Powell, in the context of his two-day testimony before the US lawmakers. Powell’s remarks, coupled with other factors, pushed gold price to record, to touch its highest level in its history at the end of that period, and it is still expected to continue this recent surge.

Gold price’s surge was compared to the less than modest performance of US stocks and the US dollar’s decline after they were affected by the deterioration in US jobs, employment data, which caused a shock to US assets in general.

The deterioration of risk appetite after the NFP data led investors to buy standard US Treasury bonds, which led to an increase in their value and, consequently, a decline in their yields by the end of last trading week due to the inverse relationship between yields and the value of the sovereign bonds.

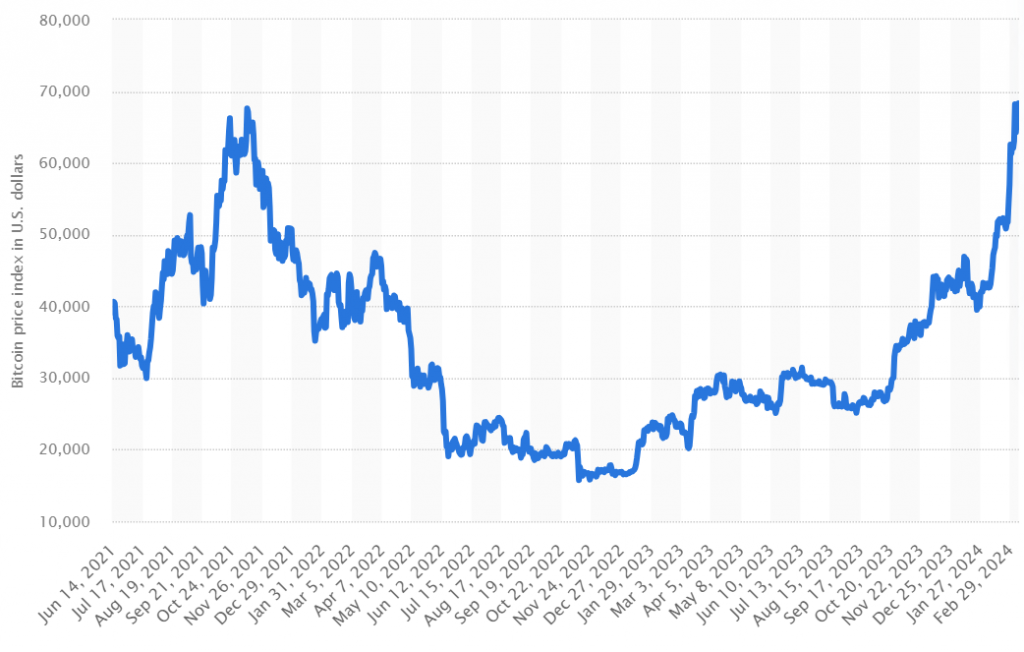

Bitcoin also continued to rise over the week, exceeding its historical highs to achieve a new record high. The largest cryptocurrency in terms of transaction volume exceeded $70,000.

The Euro concluded the trading week ending March 8, in an upward trend, despite rising expectations that the European Central Bank will begin reducing interest rates soon. The shared currency derived its current upward momentum from optimism about the future path of the Eurozone economy, which was reflected in the updated economic estimates issued by the monetary authorities.

Jerome Powell, Interest Rate Expectations

“Let’s get a little bit of data going forward so we can be more confident,” Fed Chair Jerome Powell said, on Wednesday, in his semi-annual testimony on economic conditions before the US House of Representatives.

Powell added: “We need to have more confidence in the progress we have made on the inflation front, and we already have confidence in that, but we want more of it.” “The data that will appear in the coming period may determine the date of reducing interest rates”, Powell continued.

The Chairman of the Federal Open Market Committee confirmed to lawmakers in the US House of Representatives last Wednesday that “the Committee is not convinced that continued progress towards the official inflation target set at 2.00% is ‘guaranteed,’ suggesting that the Committee will not see lowering interest rates as meaningful until it is completely confident of that.

Despite this, Fed Chair is still convinced that it will be appropriate to reduce interest rates this year, suggesting that “the situation in terms of inflation has witnessed a noticeable improvement over the past year without any significant jumps in the unemployment rate.” Powell also stressed that “the labor market is witnessing a relative improvement, although the high rate of immigration has led to the availability of a lot of labour.

Jerome Powell continued: “If the economy shows performance consistent with expectations, we will carefully consider cutting rates this year.”

Powell also stressed that he expected “a rate cut later this year,” but he did not mention a specific timeframe for that. Fed Chair suggested that “monetary policy movements will depend on new data amid the lack of sufficient evidence that inflation is heading to decline towards the official target set at 2.00%.

It is likely that Powell saying “a little bit of data” may be an indication that a rate cut may occur in early May. It seems that the statements made by Fed Chair were consistent with the statements that have recently given by monetary policymakers.

These statements, as a whole, are in the interest of expectations of interest rate cut soon, as policymakers’ remarks remove some of the uncertainty that was shrouding the scene regarding the future path of the interest rate.

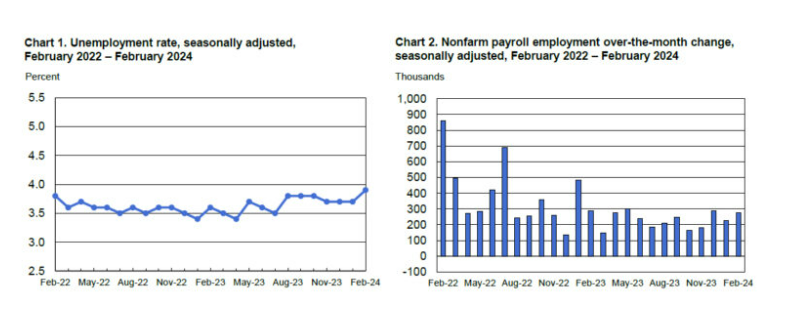

US Employment Data

The Non Farm Payrolls in the United States rose to 275,000 jobs last February, but the previous reading of the index was downwards revised to 229,000 jobs compared to the actual reading, which recorded 353,000 jobs. The latest reading was also higher than market estimates of 200,000 jobs.

Wage growth indicators declined, as the Average Hourly Earnings Index in the United States fell to 0.1% and 4.3%, compared to 0.5% and 4.4% the previous month, at the monthly and annual levels, respectively.

The US Unemployment Rate also rose to 3.9% last February, compared to the previous reading of 3.7% and higher than the previous reading recorded the previous month.

After it became obvious to investors in the global financial markets that conditions in the labour market were deteriorating, they began to become convinced that this deterioration was in favour of expectations of an interest rate cut in the first half of this year, after the US central bank came close to ensuring that its efforts in the battle against inflation have proved fruitful in terms of price stability and labour market conditions.

For about eighteen months, the Central Bank has been aiming to control conditions in the US labour market and push them in the direction of a decline in job growth and wage growth in order to place obstacles in the path of inflation to prevent it from continuing to rise, namely by depriving inflation of one of its tributaries, which is wage growth.

Gold, US Treasury Yields

Last week witnessed several important events and movements in terms of their impact on overall trading transactions. The week closed with a sharp decline in the US dollar in addition to weak performance of risk-linked assets amid mixed risk appetite due to the growing importance of the statements and data received by the markets throughout the trading week.

Gold was able to mater the scene by the end of last week, benefiting from the pressure on the US dollar because of rising expectations that the Federal Reserve could start cutting interest rates next June following statements by Fed Chair Jerome Powell, in the context of his two-day testimony before the US lawmakers. Powell’s remarks, coupled with other factors, pushed gold price to record, to touch its highest level in its history at the end of that period, and it is still expected to continue this recent surge.

Gold price’s surge was compared to the less than modest performance of US stocks and the US dollar’s decline after they were affected by the deterioration in US jobs, employment data, which caused a shock to US assets in general.

The deterioration of risk appetite after the NFP data led investors to buy standard US Treasury bonds, which led to an increase in their value and, consequently, a decline in their yields by the end of last trading week due to the inverse relationship between yields and the value of the sovereign bonds.

Bitcoin also continued to rise over the week, exceeding its historical highs to achieve a new record high. The largest cryptocurrency in terms of transaction volume exceeded $70,000.

The Euro concluded the trading week ending March 8, in an upward trend, despite rising expectations that the European Central Bank will begin reducing interest rates soon. The shared currency derived its current upward momentum from optimism about the future path of the Eurozone economy, which was reflected in the updated economic estimates issued by the monetary authorities.

Gold continued to achieve new record highs over the past week, benefiting from mounting speculation that the Federal Reserve will cut interest rates before the end of the first half of 2024.

These speculations escalated after Federal Reserve Chairman Powell had made his statements, as part of his testimony on economic conditions before the US lawmakers last week, which showed a strong tendency to cut interest rates soon.

Employment data that appeared last Friday also contributed to strengthening speculation that the Federal Reserve may cut interest rates soon after it highlighted the deteriorating labour market conditions in the United States.

Friday’s data raised speculation that the Federal Reserve could begin cutting interest rates in the first half of last year, given that labour market conditions took the preferred path favored by the Federal Reserve during its war on inflation.

Since March 2022, the Fed has been aiming to bring about a decline in labour market conditions until wage growth calms down, and then a major factor in the rise in prices declines, which is the high cost of labour. Therefore, this data was one of the most important factors that led to the record highs that gold price has recently hit.

Powell’s statements as well as the employment data were behind the intense pressure on the US dollar, which is in favour of the precious metal given the inverse relationship between USD and the yellow metal.

Bitcoin

Bitcoin concluded last week’s trading in an upward trend after recording new record highs twice in a row. These levels were unprecedented, as the most widespread cryptocurrency in the world exceeded the $70,000 level in the five trading days ending on the eighth of this March.

The factors that most pushed the largest cryptocurrency in terms of transaction volume to these unprecedented levels include the increase in institutional demand for Bitcoin since the US Securities and Exchange Commission approved the establishment of investment traded funds with Bitcoin futures contracts, in addition to the looming Bitcoin’s halving that the digital asset markets will witness in mid- April.

A report issued by Deutsche Bank summarized the secret behind the significant surge recently achieved by Bitcoin, suggesting that it is due to the fact that this type of asset has become more “institutional.” The report also attributed the institutional character that has begun to increase of the most widespread cryptocurrency in the world to the recent approval of establishing investment funds traded in Bitcoin futures contracts last January.

The report also pointed out that these funds have attracted investment flows of about $7.9 billion since the US Securities and Exchange Commission approved the establishment of investment funds of this type on January 10.

The report stated that halving is expected to reduce the rewards for miners in the most important cryptocurrency ever in mid-April, this, in turn, will cause a scarcity of new Bitcoin units that are added to the blockchain networks, which will result in a decline in supply, and thus an increase in the price.

The total volume of Bitcoin transactions rose at the end of last week to $1.314 trillion at the end of the trading day on Thursday, while the volume of daily transactions rose to $46.673 billion on the same day.

What To Watch In The New Trading Week:

Investors and traders are anticipating the US February CPI report next Tuesday, and observers are looking to inflation data for signals on the path of the Fed’s future decisions. Fed officials are scheduled to enter the “Blackout Period,” as they cannot provide comments before the monetary policy meeting, which will be held on Tuesday, March 19 and Wednesday, March 20.

The latest inflation readings that will be announced this week are the most prominent events on the economic agenda, which includes a limited number of economic data releases. Investors will also receive data on the federal budget, in addition to the reading of the Empire State Index on March 15, and next Thursday, the Producer Price Index data will be released, retail sales, and finally the Michigan Consumer Confidence Index for March.

Earnings reports from Dollar Tree and Dollar General are expected to reveal consumer spending trends in the United States, while other reports will provide a deeper understanding of the technology and housing markets. Adobe’s earnings will also indicate whether it is still able to benefit from the recent boom in the Artificial Intelligence technology. In the Eurozone, markets are awaiting the Harmonized Consumer Price Index for February and Industrial Production data for January. In the United Kingdom, Unemployment Rate data will be released, and in Australia, Westpac Consumer Confidence Index data will be released.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations