Global financial markets this week grappled with heightened volatility driven by U.S. tariff policies, monetary policy adjustments, and geopolitical developments. U.S. equities saw mixed performance, with the S&P 500 down 1.5% and the Nasdaq falling 2.6%, pressured by semiconductor export restrictions. The bond market offered some stability, though 10-year Treasury yields spiked to 4.592% before easing to 4.305%.

The U.S. dollar weakened, with the Dollar Index dropping to 99.31, boosting major currencies like the euro (EUR/USD at 1.139), British pound (GBP/USD at 1.3294), and Canadian dollar (CAD/USD at 1.3875).

Gold held above $3,300 despite a dip from historical record to $3,317.87, while Bitcoin surged to $84,699 amid trade deal optimism. Oil prices rose over 3%, with Brent at $67.96, fueled by U.S.-EU trade hopes and Iran sanctions. Corporate earnings showed banking resilience but tech sector challenges. Central banks, including the ECB and Bank of Canada, adopted cautious stances amid trade uncertainties.

Equity Markets

U.S. Market Performance

U.S. equity markets faced tariff-related headwinds, with the S&P 500 declining 1.5% (year-to-date down 10.2%) and the Nasdaq dropping 2.6% (down 15.7% for 2025). New U.S. export controls on semiconductors, particularly impacting NVIDIA’s $5.5 billion Q1 charge, weighed heavily on tech. Thursday’s mixed session saw the Dow Jones Industrial Average fall 436 points (1.0%) to 39,248, the S&P 500 rise 0.4% to 5,294, and the Nasdaq dip 0.2% to 16,291. U.S. futures reflected cautious optimism, with S&P 500 futures up 0.8% and Nasdaq 100 futures rising 1.2%, supported by tech recovery and trade deal hopes.

Q1 2025 earnings highlighted banking strength: Bank of America (EPS $0.90 vs. $0.82 expected), Citigroup (EPS $1.86), and Goldman Sachs (EPS $12.27) outperformed, driven by trading revenues. Healthcare was mixed, with Johnson & Johnson’s $14.6 billion acquisition fueling optimism, while UnitedHealth faced tariff pressures. Technology underperformed, with ASML reporting weak Q1 bookings. Analysts project 7.3% S&P 500 earnings growth, though tariffs could trigger revisions.

European Markets

European equities traded cautiously ahead of the ECB’s rate decision. Germany’s DAX rose 0.4%, while France’s CAC 40 and the UK’s FTSE 100 fell 0.2%. The Stoxx 600 declined 0.3%. Earnings were mixed: Pernod Ricard’s 3% sales drop reflected tariff impacts, while Hermès reported a 7% sales increase. ABB’s 22% profit rise and Taiwan Semiconductor’s 60% Q1 profit surge bolstered sentiment. Investors awaited ECB guidance, expecting continued easing amid weak inflation (2.2% in March).

Japanese Markets

Japan’s Nikkei 225 gained 1.03% on Friday to 34,730.28, achieving a 3.41% weekly rise—its strongest in three months—driven by U.S.-Japan trade talk optimism. Pharmaceuticals, led by Chugai Pharmaceutical’s 17.54% surge, and shipping stocks outperformed, while chip stocks like Advantest (-2.26%) lagged due to U.S. export restrictions. The Topix index rose 1.14%, reflecting broad market strength.

Currency Markets

U.S. Dollar Weakness

The U.S. dollar weakened, with the Dollar Index falling 0.09% to 99.31, pressured by trade tensions and President Donald Trump’s attacks on Federal Reserve Chair Jerome Powell, including threats to dismiss him. These remarks, made on Thursday, raised concerns about Fed independence, undermining USD confidence. The dollar’s decline supported gains in major currencies, including the euro, pound, Canadian dollar, and Russian rouble.

Euro Gains

The euro rose 0.28% to 1.139 against the USD in subdued Good Friday trading, nearing its weekly high of 1.1400. Technical analysis suggests potential to breach 1.1473 (April 11 high) and target 1.1498. ECB Governing Council member Madis Müller justified the recent 25-basis-point rate cut to 2.25%, citing declining energy prices and tariff impacts, but warned of inflationary risks from economic fragmentation. The ECB’s data-dependent stance signals two potential additional cuts by year-end 2025.

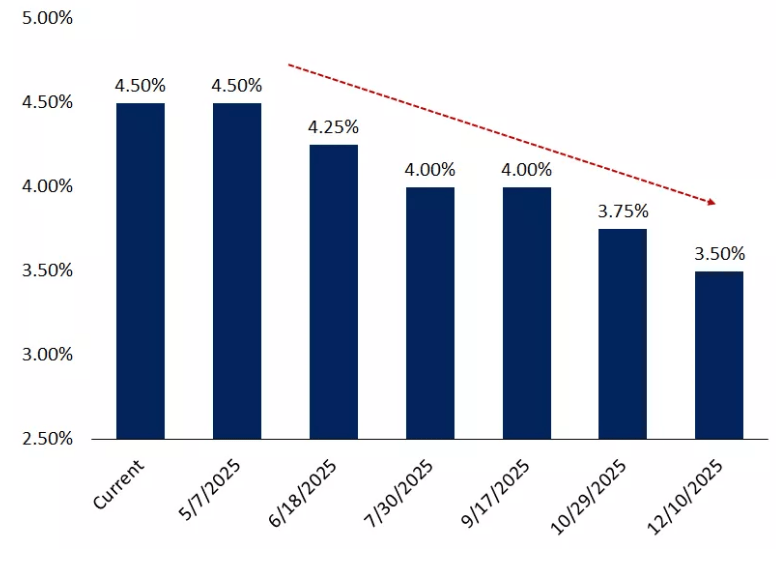

U.S. interest rate expectations for the remainder of 2025 – Source: FedWatch Tool

Sterling Strengthens

The British pound gained 0.8% weekly, closing at 1.3294 against the USD (up from 1.3265), driven by optimism over U.S.-UK trade talks led by Chancellor Rachel Reeves and USD weakness. Upcoming UK employment data, including stable unemployment rates and a projected drop in unemployment claims to 30,300 from 44,200, could further support GBP. The GBP/USD pair hit a high of 1.3299 and a low of 1.3252 on Friday.

Canadian Dollar Performance

The Canadian dollar (CAD) strengthened 0.6% against the USD on Wednesday, trading at 1.3875 (72.07 U.S. cents), nearing a five-month high of 1.3827 touched on Monday. The Bank of Canada’s decision to pause rate cuts at 2.75%, after seven consecutive reductions, provided support amid uncertainties surrounding U.S. tariff policies. Governor Tiff Macklem highlighted the inability to issue regular economic forecasts due to trade risks, adopting a wait-and-see approach. Investors see a 50% chance of a rate cut on June 4, with two additional cuts expected by year-end. Speculators have reduced bearish bets on CAD to the lowest since October, per U.S. Commodity Futures Trading Commission data. The rebound in oil prices (up 1.8% to $62.45 per barrel) and a broad USD decline further bolstered the loonie. Canadian 10-year bond yields rose slightly to 3.121% from an eight-day low of 3.078%, reflecting mixed yield dynamics.

Russian Rouble and Japanese Yen

The Russian rouble surged 1.5% to 80.90 per USD, a 10-month high, driven by a 3% rise in Brent crude to $67.96 and optimism over Moscow-Washington relations. It gained 0.1% against the Chinese yuan to 11.08. Conversely, the Japanese yen weakened, with USD/JPY rising to 142.43 from 141.89, pressured by U.S.-Japan trade deal hopes and reduced safe-haven demand. Bank of Japan Governor Kazuo Ueda emphasized cautious policy adjustments amid tariff uncertainties.

Commodity Markets

Gold and Precious Metals

Gold prices eased 0.8% to $3,317.87 per ounce on Thursday after hitting a record $3,357.40, driven by profit-taking and a slightly stronger USD. Weekly gains exceeded 2%, supported by trade tensions and USD weakness. Silver fell 0.9% to $32.44, platinum held at $967.08, and palladium dropped 1.5% to $956.92. Technical analysis points to $3,200 as a key support level.

Oil Markets

Oil prices surged over 3% on Thursday, with Brent crude at $67.96 (up $2.11) and WTI at $64.68 (up $2.21), achieving a 5% weekly gain. U.S. sanctions on Iran’s oil exports, targeting Chinese refineries, and U.S.-EU trade talk optimism drove the rally. U.S. crude inventories rose by 515,000 barrels, but gasoline and distillate drawdowns signaled strong demand. OPEC’s updated output cuts and tariff-related demand concerns tempered the outlook.

Cryptocurrencies

Bitcoin rose 1.6% to $84,699, rebounding from a $83,000 low, supported by trade deal optimism with Japan and China. Altcoins rallied, with Ethereum (+2.8%), XRP (+2.4%), Solana (+8%), and Cardano (+3.3%) gaining. Despite $171 million in Bitcoin ETF outflows, total crypto market volume hit $2.7 trillion. Bitcoin’s hold above $84,000 is critical for bullish momentum.

Bond Markets and China’s Treasury Holdings

U.S. Treasury Market Volatility

U.S. 10-year Treasury yields spiked to 4.592%—a 2025 high—after Trump’s April 2 tariff announcements, later easing to 4.305% but rising to 4.33% post-Powell criticism. Speculation about China dumping Treasuries grew after heavy selling in Asia on April 9, but the U.S. Treasury Secretary refuted aggressive foreign sell-off claims on April 15. China’s Treasury holdings, at $760 billion in January 2025, reflect a strategic shift toward European bonds, gold, and other assets. A large-scale sell-off is unlikely due to economic interdependence.

Chinese Diversification Trends

Chinese investors are favoring European bonds (German, Spanish, Italian) and Japanese government bonds, driven by trade war uncertainties and attractive yields. Germany’s spending package and potential ECB rate cuts enhance European asset appeal. China’s March credit expansion via bond offerings prioritizes domestic stability. The U.S. bond market’s depth, supported by buyers like Japan, ensures resilience.

Monetary Policy Developments

Federal Reserve’s Cautious Stance

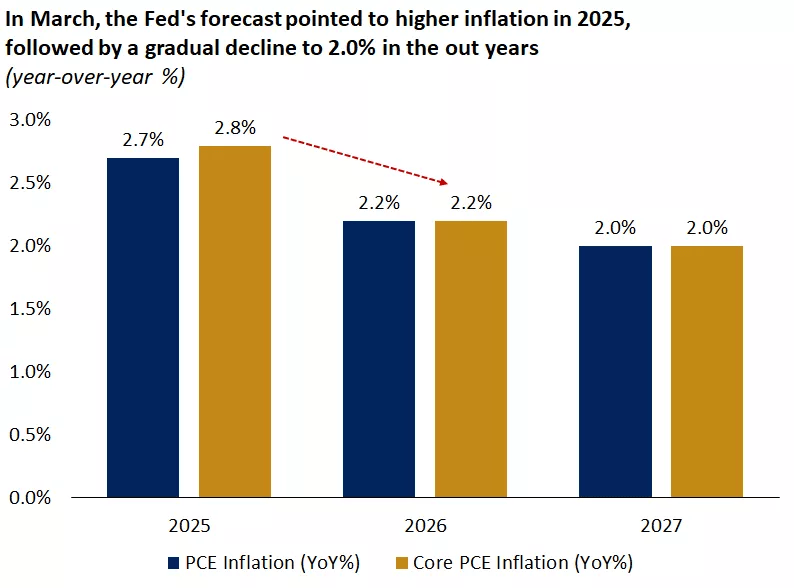

Jerome Powell warned of stagflation risks from tariffs (25% on aluminum/steel, 145% on Chinese goods, 10% on all imports), projecting higher prices, slower growth, and rising unemployment. Speaking in Chicago, Powell noted consumer spending and low unemployment as strengths but highlighted declining confidence and business investment. The Fed is holding rates steady, monitoring inflation (3.9% vs. 2% target), retail sales (up 1.4% in March), and trade distortions. Upcoming data, including PMI and jobless claims, will guide policy.

ECB’s Rate Cut and Outlook

The ECB cut rates by 25 basis points to 2.25%, its seventh in a year, driven by weak inflation (2.2% in March) and tariff pressures. President Christine Lagarde cited declining energy prices and trade uncertainties, expressing optimism about infrastructure spending. The ECB’s flexible, data-dependent policy suggests two additional cuts by 2025. German producer prices fell 0.2% year-on-year, reinforcing disinflation.

Source: FOMC, inflation forecasts as of March 2025.

Bank of Canada Pauses Rate Cuts

The Bank of Canada paused rate cuts at 2.75% after seven reductions from 5.00%, citing U.S. tariff uncertainties. Governor Tiff Macklem outlined two scenarios: a deep recession or sharp inflation spike. Investors see a 50% chance of a June 4 cut, with two more expected by year-end. The bank prioritizes inflation control and growth support amid trade risks.

Tariff Scenarios and Economic Impacts

Moderate Tariffs (10%–15%)

In the likely moderate-tariff scenario, U.S. tariffs average 10%–15%, with elevated rates on China and sectors like autos. Inflation may rise to 3.5%–4%, peaking in 2025, while GDP growth slows to 1% without a recession. The Fed may implement two to three rate cuts by mid-2025, with markets pricing in four. Equity markets could stabilize, with flat S&P 500 returns, and bond yields range between 4.0%–4.5%.

High Tariffs (25%)

A high-tariff scenario (25% average rates) could push inflation to 5% and trigger a recession. The Fed may cut rates four to five times, with the S&P 500 risking a 20%+ bear market drop. Bond yields could fall below 4.0%. The White House’s plan to tariff Chinese ships could disrupt global shipping, escalating U.S.-China tensions.

Trade Diplomacy Progress

Trump’s “big progress” in trade talks with Japan, the EU, and China raised de-escalation hopes. Japanese Minister Ryosei Akazawa and Italian PM Giorgia Meloni expressed optimism, while the EU’s Ursula von der Leyen signaled negotiation openness. These developments supported risk assets like equities and Bitcoin.

EU Financial Independence Initiatives

The EU is advancing a homegrown payment system, Wero, to reduce reliance on U.S. and Chinese networks (Visa, Mastercard, PayPal). The ECB aims to complement existing systems, enhancing financial sovereignty. A digital euro and unified capital market could bolster resilience, with Wero targeting e-commerce and in-store payments by 2025.

Portfolio Positioning

Investors are expected to face heightened volatility, with two to three pullbacks expected in 2025. Long-term strategies should emphasize:

• Equities: Diversified portfolios; equal-weight indices may outperform tech-heavy benchmarks.

• Bonds: Critical for stability, with yields likely at 4.0%–4.5% in moderate scenarios.

• Commodities: Gold and oil as hedges against inflation and geopolitical risks.

• Currencies: EUR, GBP, and CAD may benefit from USD weakness, pending trade and data outcomes. Maintaining cash reserves and rebalancing to capture quality investments will be key. Historical data supports positive returns over 10–20 years, underscoring the value of disciplined investing amid 2025’s uncertainties.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations