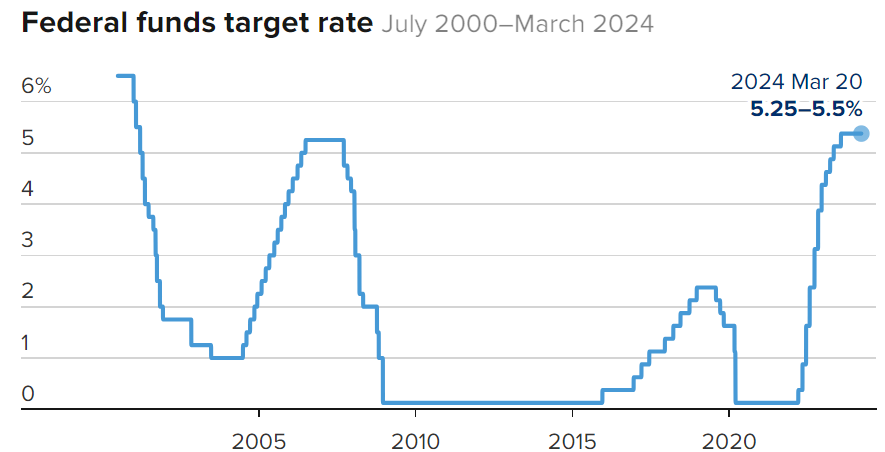

Global inflation-linked concerns, lest it should return to the previous highs, continue to reveal themselves in the context of the precautionary rhetoric adopted by major central banks worldwide. In practice, monetary policymakers have announced, through formal decisions, their intention to keep interest rates “higher for longer”, an important tool, until economic data can provide enough evidence on the victory in the battle against inflation. Last week’s biggest focus was on the Federal Reserve as well as the inflation data in the United States.

Worldwide Central Banks

“We continue to make good progress in reducing the inflation rate, and we remain firmly committed to reducing inflation to 2.00% over time, but we emphasize that it’s over time, we will see a decline in inflation of goods and services, which will lead to a decline in inflation in general to 2.00% on a sustainable basis,” said Fed Chair Jerome Powell, stressing that the risks surrounding the US economy still move in both directions.

Powell also pointed out that the indicators of personal consumption expenditures and consumer prices released last January led the Fed to expect the possibility of reviewing those readings later.

Powell added: “When we combine the figures (inflation readings) that appeared last January and February, I do not think that the road may be bumpy, but rather “I see that clearer signs are emerging of a decline in inflation.”

Powell added: “I do not think that these numbers may add to our confidence that inflation is declining, nor do I think that inflation rates may be higher in the long term.”

As inflation rose in 2022, the Fed moved to prevent a wage-raising spiral by raising interest rates and now, in light of rising unemployment, the US central bank is signaling a willingness to cut interest rates to avoid a spiral in the labour market it pledged to support, even if it means Inflation rises somewhat for a short period of time.

For the first time during the current recovery in the US economy, Fed’s Jerome Powell used his opening statement at the press conference on Wednesday to announce that a sudden increase in unemployment could prompt the Fed to cut interest rates, and then he repeated that message several times in the course of his responses to questions by journalists.

The Bank of England kept interest rates, at their highest level in 16 years even as inflation in the United Kingdom fell to its slowest pace in more than two years.

Last Thursday, BoE’s monetary policymakers decided to keep the main interest rate at 5.25 percent for the fifth meeting in a row, one day after important data revealed a decline in the inflation rate in the UK to 3.4 percent.

The BoE’s decision was widely expected, but analysts have been tracking the vote count by the nine-person interest rate-setting committee to see if there is consensus on whether rate increases are under control and when rate cuts might begin.

Eight members of the committee voted to keep interest rates unchanged, with two policymakers who voted in favour of raising interest rates last month abandoning their previous stance, and one member voting in favour of lowering interest rates.

BoE Governor, Andrew Bailey announced that policymakers kept interest rates unchanged “because we need to make sure that inflation will fall to our target of 2% and will remain at that level,” adding, “We have not yet reached the point where we can lower interest rates, but “Things are moving in the right direction.”

Source: Investing.com

SNB’s Unexpected Decision

The Swiss National Bank cut its key interest rate, on Thursday, by 25 basis points to 1.50% at the March 2024 meeting, which is the first Swiss rate cut in nine years.

With this surprise, the SNB became the first central bank to reduce interest rates amid expectations that the European Central Bank and the Federal Reserve will take the same step next June.

This step came in the wake of the decline in the Swiss inflation rate to 1.2% last February, remaining stable within the target range of the Swiss central bank at 0-2% for the ninth month in a row.

SNB expected the annual inflation rate to stabilize at 1.4% during the current year 2024, 1.2% during the next year 2025, and 1.1% in 2026. It also expected economic growth to remain moderate during the coming quarters amid speculation that the growth rate would stabilize around 1% during this year.

BoJ

The Japanese yen fell against its American competitor, on Tuesday, towards the 150.00 barrier, falling to its lowest levels in nearly two weeks after the Bank of Japan raised interest rates for the first time in eight years in light of rising levels of both wages and inflation.

The USD/JPY pair rose by 0.80% to the level of 150.33 yen from the opening level of current trading today at 149.14 yen. The pair rose to its highest levels during the session at 150.48 yen from its lowest levels at 148.97 yen.

During the monetary policy meeting for March, the Japanese central bank raised the short-term interest rate to 0.1% compared to -0.1%, in line with market expectations, and also announced the cessation of the yield curve control policy, which sets a ceiling for the ten-year Japanese government bond yield at 0.1%.

ECB Has a Word Too

The European Central Bank also tried to dispel, or rather dampen, speculation about a series of interest rate cuts, last Wednesday even as the central bank acknowledged encouraging data on a slowdown in price and wage increases.

Several ECB policymakers have expressed support for the first cut in borrowing costs from their current record highs, likely next June, with internal discussions among Eurozone monetary policymakers now focusing on how many further cuts might follow.

But ECB President, Christine Lagarde, said that the European Central Bank cannot commit to a certain number of interest rate cuts even after it begins to reduce borrowing costs. Lagarde pointed out that the Central Bank’s decisions must remain based on data and for each meeting separately, and respond to new information as it arrives. “This means that even after the first rate cut, we cannot pre-commit to a certain rate path,” she said at a conference in Frankfurt. Philip Lane, ECB’s chief economist was echoing Lagarde’s statements, stressed that he and his colleagues will “calibrate the appropriate level.” interest rates for a long time to come.”

Cryptocurrencies

In the past trading week, Bitcoin ETFs posted record outflows, the most popular cryptocurrency saw a bearish turn, and the second largest cryptocurrency, Ethereum, faced regulatory issues.

Do Kwon, founder of Terraform Labs, made headlines after a Montenegrin court rejected Do Kwon’s appeal against his extradition to South Korea. US authorities are also looking to appeal the extradition decision amid plans to release Terra’s founder from prison, as he has finished his sentence, after being charged with possession of illegal documents.

The downward trend that began the previous week extended to this week, as the market witnessed a continued downward consolidation in Bitcoin. Bitfinex, a cryptocurrency exchange owned and operated by IFINEX registered in the British Virgin Islands, stressed that traditional investors, most of whom entered the market through Bitcoin ETFs, are more cautious.

The global cryptocurrency market value lost $140 billion this week, with Bitcoin leading the decline with a 4% price drop this week and the leading cryptocurrency ending the week around the $65,000 price level.

Despite the downward trend, industry leaders remained optimistic and Richard Teng, CEO of Binance, predicted that Bitcoin would surpass the $80,000 threshold. In addition, MicroStrategy revealed on March 19 that it had purchased an additional 9,245 Bitcoins, demonstrating its optimism about the most important crypto asset in the world.

Last week was extremely difficult for Bitcoin ETFs, as they were unable to attract strong inflows day after day. As a result, spot Bitcoin ETFs have seen consecutive daily inflows every day in the past week, suggesting that bullish market sentiment among institutional traders may actually be waning.

This appears to have been reflected in the price of Bitcoin, as the cryptocurrency touched a low of $61,370 during the week.

Investor interest in spot Bitcoin ETFs skyrocketed throughout February and early March amid Bitcoin’s bull run, pushing its price to an all-time high of $73,737.

This maximum investor interest has led the ETFs to set new trading records for exchange-traded funds in the US. However, these ETFs have now set a record five consecutive negative days of outflows.

A question now is, “Will Bitcoin recover?” The world’s most widely known cryptocurrency is able to achieve a strong recovery and regain its all-time high above $73,000.

Continued outflows from spot Bitcoin ETFs may further impact the price of Bitcoin. Interestingly, the weakness in outflows had nothing to do with a decline in trading activity, as trading volume remained high throughout the week.

The data indicates that the cumulative trading volume of the ten ETFs now stands at $164 billion after witnessing a trading volume of $22.71 billion last week.

After a week of remarkable outflows, the coming days are expected to be crucial in determining the next major move in the price of Bitcoin. Despite the rough week, Bitcoin still has a chance to bounce back to $73,000, or perhaps higher, especially with the next halving event, looming, next April.

Price Action

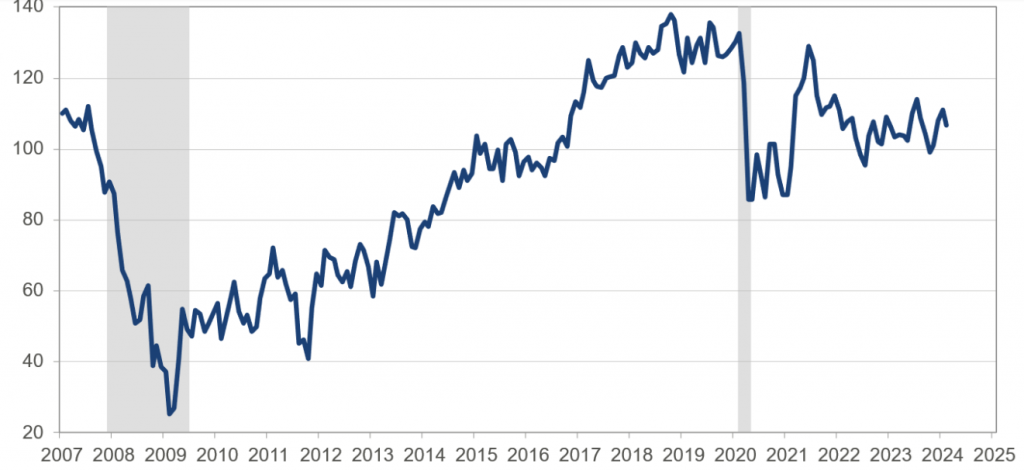

Global stocks ended last week’s trading in an upward direction after the Federal Reserve confirmed that it had made a lot of progress in combating inflation after a nearly two-year battle with rising prices.

Some global stock indices rose to new record levels, with the Dow Jones Industrial Average and the Standard & Poor’s 500 rising to new record levels. The two indices achieved weekly gains of approximately 2.00% and 2.3%, respectively, indicating the strongest weekly performance since last December.

Gold also achieved an unprecedented record last week, as it rose to $2,222 per ounce, compared to the lowest level of $2,146 per ounce. This came due to the relative weakness that struck the US dollar and a decline in ten-year US Treasury bond yields on a weekly basis, giving up 4.200%.

The Week Ahead

• Next week’s Personal Consumption Expenditures data will be released, the Fed’s most reliable reading, which should shed more light on the future Fed’s rate path.

This batch of US inflation data comes after the emergence of consumer price indices and producer price indices, which shed light on the return of price inflation to a rise at all levels, which has begun to spread conviction in the markets that the Fed may be patient before cutting interest rates.

• US consumer confidence data will also be on the economic calendar, which sheds light on the extent of consumer satisfaction in the United States with the performance of the economy in terms of current and future conditions.

• The markets are also awaiting earnings reports from a number of important companies, most notably GemStop and Carnival Highlight, which will have a significant influence on the financial markets.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations