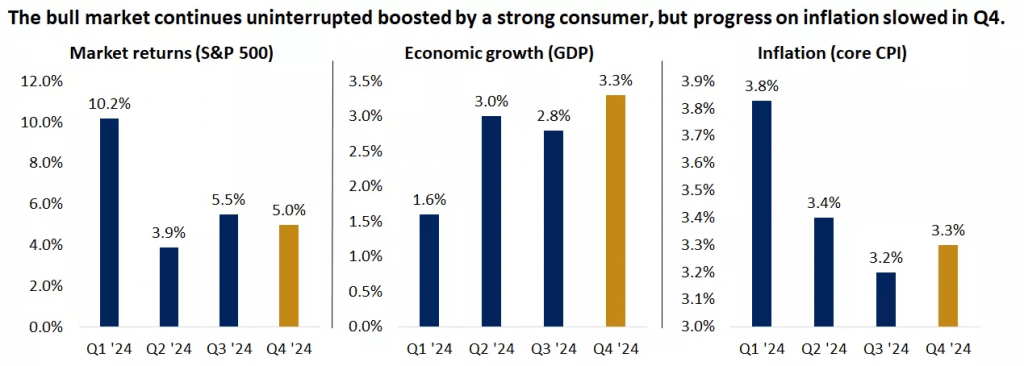

Last Monday, the Nasdaq index temporarily surpassed the 20,000-point mark, setting a new record. Strong economic growth, increasing corporate profits, moderate inflation, and the beginning of central banks easing their monetary policies have all contributed to the stock market’s successful performance this year. However, some uncertainties remain about the future path of central bank policies, especially as the fourth quarter of the year draws to a close and the progress of inflation becomes clearer.

Q4 – Source: Bloomberg

Consumer Price Index for November: Mixed Results

The Consumer Price Index (CPI) for November was not as bad as expected before the Federal Reserve’s upcoming meeting. As the last significant data point before the U.S. interest rate decision, there had been significant concern about a potential positive surprise. However, the results came in line with expectations, indicating that while the rate of inflation decline has slowed, it is not ready for a major turnaround. For the third consecutive month, core consumer inflation, which excludes volatile food and energy prices, rose 0.3%, keeping the annual rate at 3.3%. While the rate of price increases is still higher than the Federal Reserve would like, it is half the peak of 6.6% in 2022.

Food and fuel contributed to the slight increase in the headline CPI to 2.7% year-over-year, the first back-to-back annual acceleration in eight months. Prices for cars, furniture, hotels, and travel rose faster outside of these categories, perhaps due to continued strong consumer spending (recent hurricanes in the United States also contributed to higher demand and car prices). Based on more difficult comparisons from last year, known as “base effects,” analysts expect inflation to tick slightly higher over the next two months, but this is not believed to signal a shift in the overall trend. Leading indicators, such as prices paid by service and manufacturing companies, suggest some stability rather than a second wave of inflation.

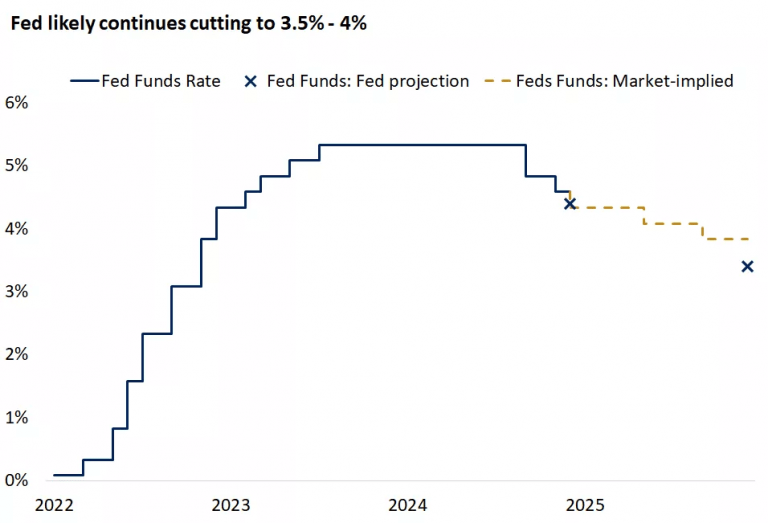

Fed Likely to Cut Rates in December, But 2025 Pace to Slow

The Federal Reserve is expected to cut interest rates this week despite last week’s data. Neither the Producer Price Index nor the Consumer Price Index revealed any major surprises, and the rise in the unemployment rate last month supported policymakers’ belief that the labor market is no longer a source of inflationary pressure. The bond market is already pricing in a 95% probability of another quarter-point cut in December, although the Fed’s September projections pointed to two more cuts this year, one of which was executed in November.

No Rush in the New Year

As financial markets are heading enter 2025, the Fed is likely to slow the pace of easing, as uncertainty over the path of inflation rises. Progress in bringing down inflation has slowed, and potential changes in fiscal, trade, and immigration policies could complicate the Fed’s efforts to reach a neutral rate, a level that is neither restrictive nor stimulating for the economy. The Fed’s updated interest rate projections in December may shift slightly higher, anticipating a slower pace of easing in the future, as both growth and inflation have been stronger than expected since September. Most investors expect two to three rate cuts in 2025, with the federal funds rate stabilizing in the 3.5% to 4% range by the end of the year.

Other Central Banks Have Reasons to Accelerate Their Move to Neutral Policy

The Bank of Canada is leading this charge. Last week, the Bank of Canada cut its policy rate by half a percentage point to 3.25%, the upper end of its estimated neutral rate range of 2.25% to 3.25%. Over the past six months, the bank has cut rates by 1.75%, a faster and deeper pace than any other advanced economy. With the population growing faster than employment, core inflation was within the Bank of Canada’s target range, fourth-quarter economic growth was weaker than expected, and unemployment rose to a two-year high of 6.8%. All of these factors point to the need for policy to move away from the restrictive zone, but now that rates are approaching neutral, the authorities indicate that they will scale back rate cuts and proceed more slowly.

As expected, the Reserve Bank of Australia decided to keep its cash rate target unchanged at a 13-year high of 4.35%, and it has now been more than a year since the last move in the cash rate by the RBA, the thirteenth increase in a series that began in May 2022. The bank also left the interest rate paid on exchange settlement balances unchanged at 4.25%.

The European Central Bank is aware of the potential for negative outcomes. As expected, the ECB cut rates by a quarter of a percentage point last week, and the ECB’s policy rate has fallen by one percentage point to 3% after four rate cuts during this cycle. In contrast to the United States, markets have begun to price in a significant rate-cutting cycle for next year as growth and inflation forecasts are revised downward. The largest rate cut in nearly a decade has occurred in Switzerland, where the central bank surprised markets by cutting its policy rate from 1.0% to 0.5%.

The Strength of the US Dollar Reflects Divergent Expectations

With rapid interest rate cuts overseas, the gap between domestic and international interest rates is providing a boost to the US dollar against a basket of other major currencies. From an economic standpoint, this could make imported goods cheaper, helping US inflation to moderate. From a portfolio perspective, international stocks tend to underperform during periods of dollar strength, supporting the view that US equities are well-positioned to continue to lead.

Entering a More Uncertain Phase, but the Golden Equation Remains True

The trend seems clear; however, the pace, speed, and depth are up for debate. As we approach 2025, it is clear that the direction of interest rates is lower, but the speed and depth of interest rate cuts are more uncertain. Unlike this year where the Federal Reserve and other major central banks have opted for larger interest rate cuts, the pace is likely to slow as central banks try to balance easing but still have inflation above target with a resilient economy and a tight labor market. The Fed does not want to risk going too far from restrictive territory, exposing America to a potential economic slowdown, but at the same time, there are no compelling reasons to rush the easing of monetary policy.

Commodities

Crude oil prices have recently seen a rise, pushing futures contracts for crude oil to over $70 a barrel. While this upward trend is driven by factors such as OPEC+ production cuts and geopolitical tensions, a closer look reveals a more complex picture. The recent rise in oil prices appears to be a testament to the delicate balance between supply and demand dynamics in the global energy market. Undoubtedly, OPEC+ production cuts have played a significant role in supporting prices. However, the looming threat of increased US oil production, especially under the potential influence of a drilling-friendly administration, could dampen these bullish sentiments.

The strength of the US dollar, as indicated by the US Dollar Index, is also exerting downward pressure on oil prices. A stronger dollar makes commodities, including oil, more expensive for foreign buyers, which could dampen demand. While the short-term outlook for oil prices remains uncertain, it is important to consider the long-term implications of various factors. The possibility of increased US oil production could lead to a supply glut, which could put downward pressure on prices. Additionally, global economic conditions, particularly in China, a major oil consumer, can impact demand.

Gold, often considered a safe-haven asset, has faced headwinds recently as rising US Treasury yields and a stronger dollar have weighed on the price of the precious metal. While geopolitical tensions and economic uncertainty could provide support for the yellow metal, the Federal Reserve’s monetary policy decisions will play a crucial role in shaping its future trajectory. The week ended with the yellow metal trading at $2647.38, down about 1.24% from its weekly peak of $2674.08 recorded on Thursday, December 12.

The Federal Reserve’s Impact on Gold

The Federal Reserve’s stance on interest rates has a significant impact on the attractiveness of investing in gold. Higher interest rates increase the opportunity cost of holding non-yielding assets like gold, as investors can earn higher returns on interest-bearing investments. Conversely, lower interest rates can enhance gold’s appeal as a safe-haven asset. As the Fed prepares to make its next decision on interest rates, investors will be watching closely for clues about the central bank’s future monetary policy path. A more dovish stance, including potential interest rate cuts, could provide support for gold prices. However, a more hawkish stance, with higher interest rates and tighter monetary policy, could put downward pressure on gold.

Geopolitical Tensions and Economic Uncertainty

Geopolitical tensions, such as those in the Middle East and Eastern Europe, can also impact gold prices. In times of uncertainty, investors often turn to gold as a safe-haven asset to protect their wealth. However, the impact of geopolitical events on gold prices can be unpredictable and depends on a variety of factors, including the severity of the crisis and the market’s perception of the risks involved.

Economic uncertainty, such as concerns about inflation, recession, or financial market instability, can also drive demand for gold. In times of economic turmoil, investors may seek to diversify their portfolios and reduce risk by investing in gold.

Bitcoin

Since Friday, the price of Bitcoin has increased by 0.42%. The price has risen by 2.89% in the past week. The price of Bitcoin is trading up and down on the hourly chart, and overall, the beginning of the new week is likely to see trading around the small range of $101,600 to $102,600. The leading cryptocurrency has broken through the chart peak at $102,638 over a longer time frame and a correction to the $101,000 region can be expected if today’s daily close is away from that threshold.

The Week Ahead

The Federal Reserve is expected to announce its decision on interest rate cuts this week, and investors expect the central bank to cut borrowing costs again. Statements by Federal Reserve Chairman Jerome Powell on Wednesday are expected to provide clarity on the future path of interest rates and the economy.

“The Bank of Japan is expected to keep interest rates unchanged next week. Policymakers prefer to spend more time scrutinizing overseas risks and gathering evidence on next year’s wage outlook. The BoJ’s next policy meeting will be held on December 18-19.”

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations