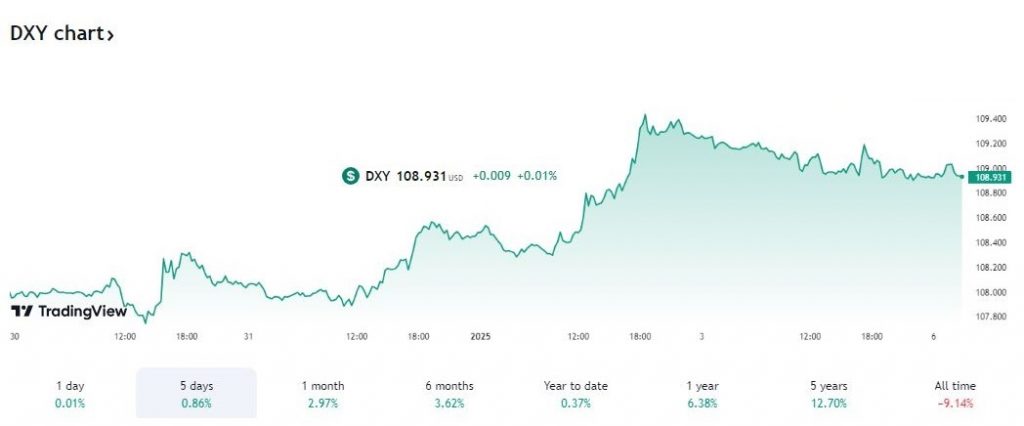

This analysis provides a concise overview of key financial instruments including the US dollar (USD), Euro (EUR), Yen (JPY), Pound Sterling (GBP), gold, crude oil, and Bitcoin, along with economic factors influencing their performance. The dollar’s trading range was between 107.96 on Monday, and 108.99 on Friday, with a significant peak at 109.434 recorded on Thursday, January 2.

USD Dominates Early 2025

The US dollar surges as the strongest currency to start 2025, reflecting confidence in the US economy and a perceived hawkish stance by the Federal Reserve (Fed). This strength is evident in the dollar’s trading range, reaching a two-year high against several currencies.

Uncertainties Account For Euro’s Decline

The Euro’s worst weekly performance since November is attributed to the robust dollar and expectations of a more dovish European Central Bank (ECB) compared to the Fed. The interest rate differential between the US and Europe is a key driver, with the ECB and Bank of England (BoE) anticipated to ease monetary policy more aggressively than the Fed.

Yen, BoJ’s Policy Walking On Tightrope

The Japanese Yen weakens as the Bank of Japan (BoJ) remains cautious about raising interest rates. This cautious stance is in contrast to other central banks, and upcoming Japanese economic data like the Services PMI, confidence index, and household spending will be crucial in determining the BoJ’s next move.

Focus on US and Japanese Data for JPY Direction

The upcoming week will see the release of US economic data, including the ISM Services PMI and JOLTS Job Openings report, which will influence USD/JPY trends. A strong US jobs report with rising wages could bolster the dollar, while weaker data might lead to bets on a Fed rate cut, weakening the dollar. Similarly, Japan’s economic data will be closely watched, with rising wages and spending potentially fueling expectations of a BoJ rate hike and strengthening the Yen.

Oil Market: Geopolitics and Speculation

The oil market is influenced by renewed optimism due to potential policy shifts under the Trump administration and uncertainties surrounding electric vehicle adoption. Stricter sanctions on Iran, anticipated under Trump, could significantly impact global oil supply and drive prices upward. Speculative trading by algorithmic traders is another factor to consider, with the potential for sharp price swings.

Gold: A Safe Haven Amidst Uncertainties

Gold prices have benefited from rising geopolitical tensions and global economic uncertainties. The yellow metal’s appeal as a safe-haven asset is driving its price increase. Central banks increasing their gold holdings further support the bullish sentiment. However, a stronger dollar could pose a short-term challenge for gold, making it more expensive for holders of other currencies. The overall impact on gold prices depends on the balance between these competing factors.

Bitcoin: Strong Fundamentals and Growing Adoption

Bitcoin starts 2025 on a strong note, backed by robust fundamentals and increasing adoption. The network’s hash rate has reached an all-time high, indicating immense computing power dedicated to Bitcoin security. Additionally, the number of cryptocurrency wallets holding significant amounts of Bitcoin is surging, signaling growing retail and institutional investor interest.

Pound Sterling: A Shaky Start to 2025

The Pound Sterling unexpectedly weakens in early 2025 trade. This decline is attributed to a weak UK manufacturing PMI and rising wholesale gas prices. Analysts believe this weakness is temporary, and the Pound could recover due to dip-buying and a focus on upcoming labor market data.

Overall, the financial markets in early 2025 are characterized by the US dollar’s strength, uncertainties surrounding central bank policies, and geopolitical tensions. Investors should closely monitor economic data releases and central bank commentary to navigate potential market volatility.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations