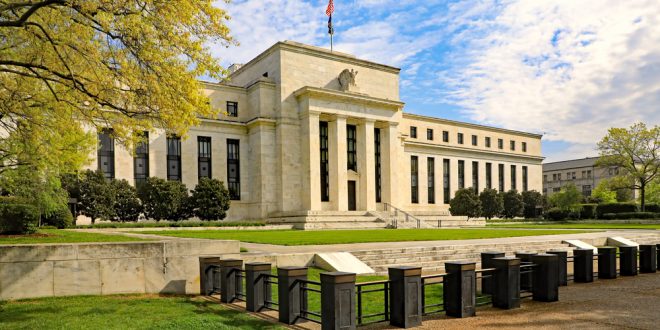

The President of the Federal Reserve Bank of Dallas, Robert Kaplan, believes that U.S. central bank should take the decision on tapering next month.

Kaplan’s remarks to CNBC came a day before the highly anticipated speech by the Federal Reserve Chairman, Jerome Powell, to the Jackson Hole economic conference.

Kaplan signaled that a decision to scale back the massive asset purchases should be taken by the Federal Open Market Committee (FOMC) in the September meeting with implementation beginning in October.

The rationale behind his stance is that the U.S. economy has reached a state in recovery in which he can handle less help from the monetary policymakers.

He also expressed concern over the rising inflation, expressing support for addressing the challenge.

“Based on everything I have seen, I do not see anything at this point that would cause me to materially change my outlook.”

“It would continue to be my view that when we get to the September meeting, we would be well served to announce a plan for adjusting purchases and begin to execute that plan in October or shortly thereafter.”

“What we are seeing is businesses and consumers are learning to adapt and go on with their lives, and they are realizing that this is not going to be neat and clean or a straight line.”

“It is going to go in fits and starts, and they are getting adjusted to that reality.”

“What we are seeing in these communities is inflation affects them disproportionately. I think at the Fed we have to take that very seriously.”

“I think we will be a lot healthier if we could soon wean off the purchases, and it will put us in a lot better position going forward.”

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations