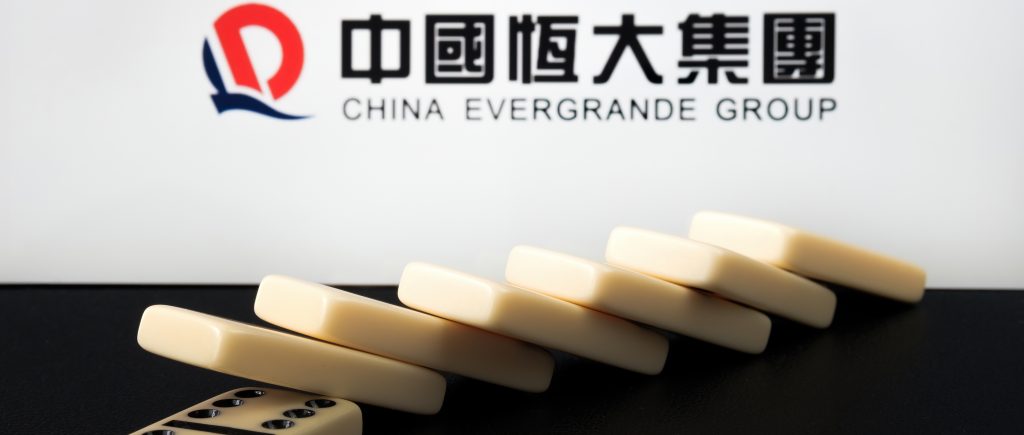

The Federal Reserve Bank warned on Monday that stresses in the Chinese real estate sector posed risk to the US financial system, pointing out that the impact of the heavily indebted property companies like Evergrande could be a potential source of worldwide contagion.

“Given the size of China’s economy and financial system as well as its extensive trade linkages with the rest of the world, financial stresses in China could strain global financial markets through a deterioration of risk sentiment, pose risks to global economic growth, and affect the United States,” the Fed warned in its semi-annual Financial Stability Report.

On the domestic front, the Fed also warned that a steep rise in interest rates could lead to a large correction in risky assets, in addition to a reduction in housing demand that in turn could lead to lower home prices. Employment and investments could take a hit too as borrowing costs for business rose.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations