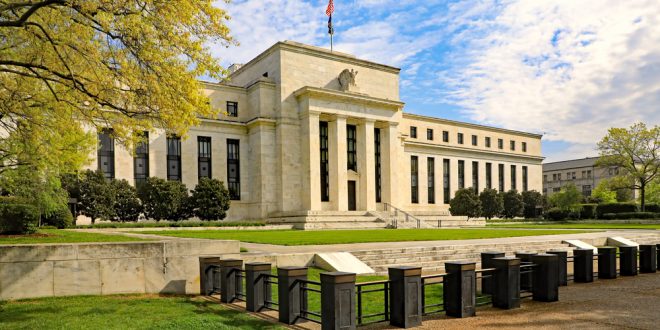

The US Federal Reserve will announce monetary policy decisions and release the updated Summary on Wednesday at 19:00 GMT. As we get closer to the release time, here are the expectations as forecast by analysts and researchers of 5 major banks.

TDS

“The taper pace will likely be doubled to USD30 B per month, consistent with QE ending in March. Officials will likely also convey a more hawkish tone through the statement, the economic projections, and the dot plot. The median dot will probably show a 50bp increase in 2022. We expect enough slowing in inflation and growth to delay rate hikes until 2023, but, for now, strong data are encouraging hawkishness. Scope for USD upside is capped given how much is priced in the front-end.”

SocGen

“We assume a majority of Fed participants expect to hike rates in 2022. We expect the median to show at least two hikes and think a large number of officials will endorse three hikes. We expect the Fed to hike three times in 2022. If it starts hiking in June as we predict, it has two more quarterly opportunities, at the September and December FOMC meetings, to hike again. Further hikes in 2023 and 2024 are likely in the Fed predictions. More hikes earlier should tend to raise odds that the Fed can raise even further. We expect the Fed to rapidly wind down its Treasury and agency-MBS purchases. By the end of March 2023, the Fed should stop purchasing these long-term assets. We assume the Fed can reduce its monthly purchases by USD30 B per month, twice the USD15 per month pace offered at the November FOMC meeting. The Fed might opt to make the change in more than one step, but we don’t see a need to.”

BBH

“We expect the pace of tapering to be doubled to USD30 B per month (USD20 B UST and USD10 B MBS). While the Fed has taken pains to try and decouple tapering from lift-off, the market is not having any of that. In the September Dots, one policymaker saw a longer-term Fed Funds rate of 2.0%, 4 saw 2.25%, 1 saw 2.375%, 9 saw 2.5%, and 2 saw 3.0%. How can markets reconcile this with a 1.5% terminal rate? They can’t, and when markets realize this, that should give the dollar another leg higher. We can come up with any number of situations where the median for end-2022 shifts to two hikes from one currently, but we think it is highly unlikely for the median to shift to three hikes. We do not think it would be hard to get a shift in the end-2023 median to four or five hikes from three currently. In light of recent data, we expect core PCE forecasts to be revised higher and unemployment forecasts to be revised lower. We do not expect significant revisions to the growth forecasts.”

Citibank

“We expect the Fed dots to drift higher. The team’s base case is for a first-rate hike in June – which is roughly priced by the market, followed by quarterly rate hikes at least until rates reach around 2%, whereas markets price a shallower path to a lower terminal rate (around 1.25-1.5%). The risks to this view are to the upside, implying markets are underpricing the distribution of outcomes. We anticipate a median for two rate hikes in 2022 with three more in 2023 and a median for rates reaching around 2.5% (the Fed’s estimate of terminal) in 2024. It wouldn’t be too surprising to see as many as three hikes in 2022 and as many as four in 2023. However, markets will likely be most reactive to 2022 median that looks likely to come in somewhere around or below market expectations. Close to three 2022 rate hikes priced and a widely expected acceleration of tapering from USD15 B/month to USD30 B/month limits remaining hawkish risks – but with asset purchases concluded in March, Chair Powell might use the press conference to signal that the March meeting is ‘live’ for a rate hike – a scenario markets currently put a low probability on. More hawkish, but less likely, would be any discussion of an earlier than expected move toward balance sheet

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations