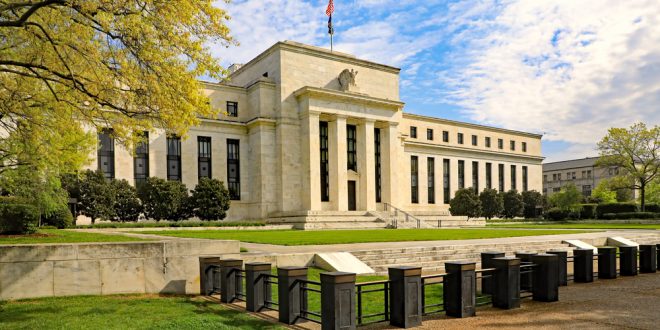

The U.S. Federal Reserve will likely maintain its current policy and make no changes in the two-day policy meeting that is concluding on Wednesday.

Some analysts have expected the policy statement will point to the next interest rate hike taking place in 2023.

Investors will closely examine the monetary policy statement and its view on the inflation rate, which recorded 5% in May, as shown by recent data.

Moreover, The Federal Open Market Committee (FOMC) will likely maintain the current easing policies and interest rates at a historically low level near 0%.

Remarks by Fed Chair Jerome Powell will be also important to identify if the inflation data led to a change in tone.

Powell previously said that a rise in consumer inflation would likely be transitory.

Last month, the inflation rate registered 5%, hitting its highest level in 13 years.

Some analysts believe that the coming months will see inflation easing, after peaking due to the comparison with the comparable period of last year, when the onset of the coronavirus pandemic prompted lockdown measures and limitation in business activities.

A number of Fed officials recently came out in support of beginning to consider a discussion about reducing the current pace of asset purchases from the current level of $120 billion a month, a move that Powell has already told us would come before any rate hikes.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations