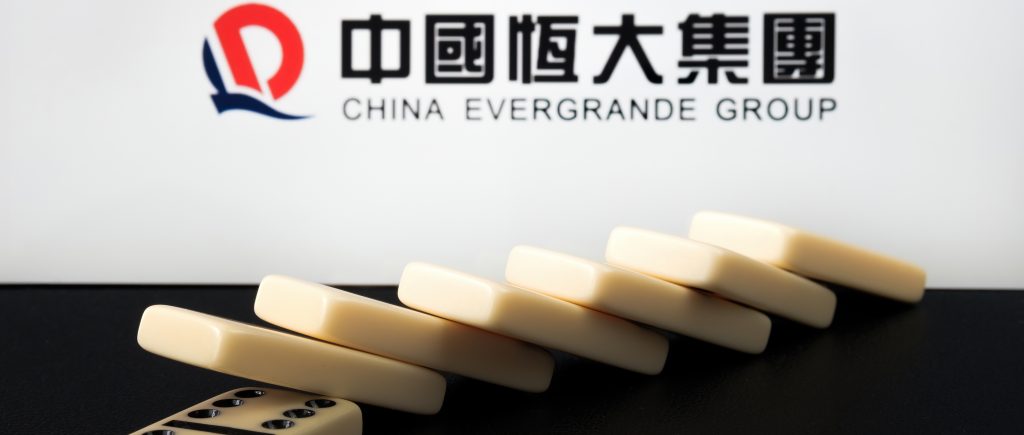

The giant Chinese real estate developer has become cash-strapped and now risks default if it fails to pay its gross debt.

After Evergrande’s efforts to sell its stake of 50 per cent of EPS to rival Hopson Development had collapsed, depriving it of valuable cash to ease the pressure on its balance sheet. Time is actually running out for China’s Group to avoid default and the company is cracking under the weight of a £221billion debt.

The company has to pay an $83.5 million bond coupon until this weekend, a situation made further pressing by impact of the recent collapse of talks to sell a stake in a unit for $2.6 billion.

Speculation about a default has been persisting for months, with concerns and pronounced fears of contagion across credit markets among other cash-strapped property developers and eroding confidence in the Chinese real estate market.

The Chinese real estate market by some measures accounts for more than one quarter of the whole economy.

Shares in crisis-hit Evergrande dived as trading has recently overcome 17 day suspension. Shares were suspended on October 4 after it said it may have found a buyer for Evergrande Property Services (EPS), one of its most profitable businesses.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations