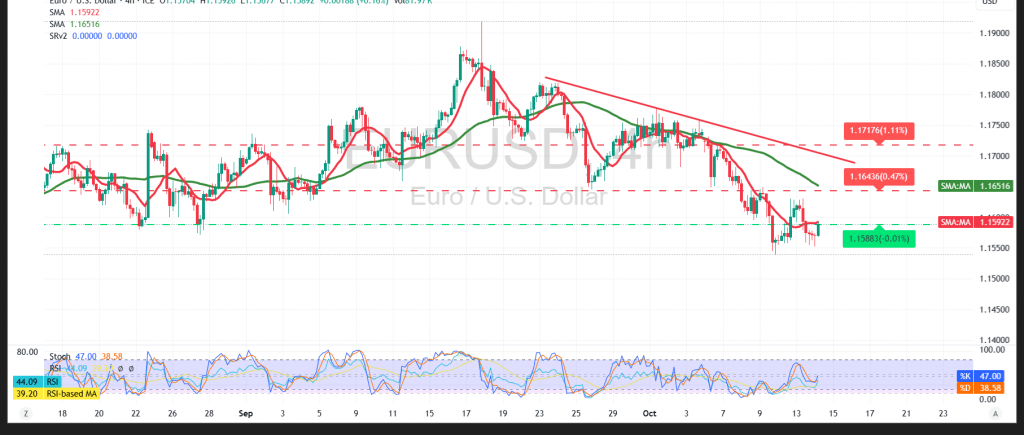

The EUR/USD pair remains under broad downside pressure, consistent with the bearish trend highlighted in previous reports. The pair extended its gradual decline, recording a new low near 1.1555, as sellers continue to dominate market sentiment.

Technical Overview

The overall trend remains decisively bearish, with price action holding below the simple moving averages, which continue to act as dynamic resistance levels, reinforcing the ongoing downward trajectory and restricting any attempts at recovery.

Meanwhile, momentum indicators, led by the Relative Strength Index (RSI), maintain negative signals despite the indicator entering oversold territory—a sign of persistent selling pressure and limited buyer strength.

Moreover, stabilization below 1.1625, and more broadly below 1.1650, continues to intensify selling momentum and confirm the dominance of the downtrend.

Probable Scenario

As long as the pair remains below 1.1650, the negative outlook stays intact.

- A break below 1.1550 would reinforce the bearish continuation, opening the path toward 1.1515 and then 1.1480 as the next potential support zones.

- Conversely, a clear move above 1.1650 could trigger a short-term upward correction, targeting 1.1665, and possibly 1.1700.

Caution

Volatility may rise significantly ahead of upcoming speeches by the Bank of England Governor and Federal Reserve Chair, as their remarks could influence market direction.

Traders should remain cautious, as risk levels remain elevated amid persistent trade and geopolitical tensions, and all scenarios remain possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1550 | R1: 1.1625 |

| S2: 1.1515 | R2: 1.1665 |

| S3: 1.1475 | R3: 1.1740 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations