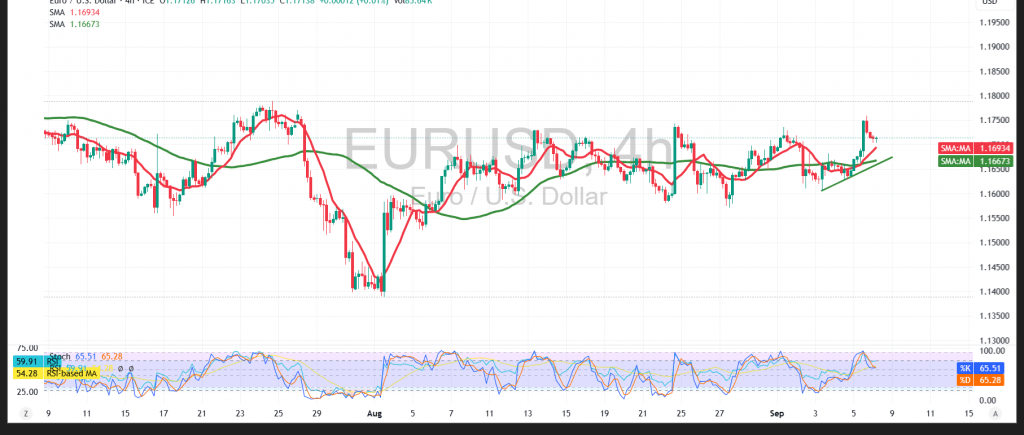

The EUR/USD pair experienced intraday profit-taking after failing to break through the key resistance at 1.1760, resulting in a limited bearish range.

Technical Outlook – 4-hour timeframe:

Intraday movements currently reflect a bearish bias as the pair corrected from overbought conditions. The Relative Strength Index (RSI) has begun to issue negative signals, indicating a temporary loss of upward momentum. However, the 50-period simple moving average continues to provide dynamic support, keeping the potential for a rebound intact.

Probable Technical Scenario:

As long as trading remains stable above the 1.1670 support, the bullish rebound scenario remains valid. A confirmed break above the 1.1730 interim resistance would act as a catalyst for renewed gains, with the first target at 1.1760, and a potential extension toward higher resistance levels as shown on the chart.

Conversely:

A sustained move back below 1.1670 would shift pressure to the downside, exposing the pair to a retest of deeper support near 1.1600.

Warning: Risks remain elevated amid ongoing trade tensions, and all scenarios should be considered.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1655 | R1: 1.1765 |

| S2: 1.1595 | R2: 1.1820 |

| S3: 1.1540 | R3: 1.1875 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations