The Euro has capitalized on the US Dollar’s decline, which fell below the 109.00 mark on the US Dollar Index, a measure of the greenback’s performance against a basket of six major currencies. This occurred despite the outcome of the European Central Bank’s December meeting.

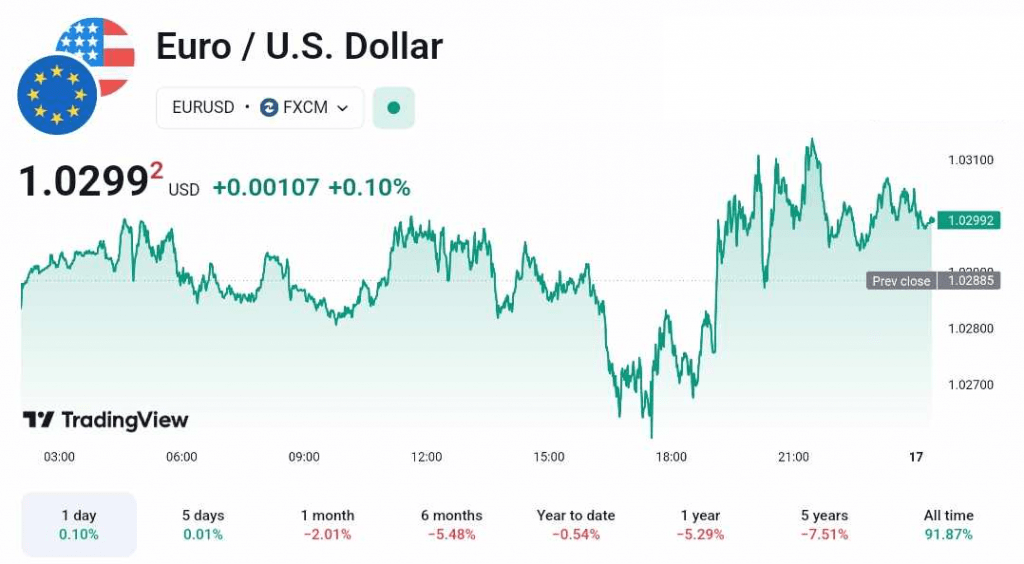

The Euro/Dollar pair rose to 1.0301, compared to the previous day’s close of 1.0288. The pair reached a daily low of 1.0259 and a high of 1.0314.

Source: TraddingView

The European Central Bank’s Accounts for December 11-12 meeting revealed that some policymakers advocated for a 50 basis point interest rate cut, indicating a potential inclination among members of the European Monetary Policy Committee towards further rate reductions.

The US Dollar has been on a downward trajectory since the beginning of Thursday’s trading, influenced by several factors including statements from the Federal Reserve, inflation data, and earnings reports released the previous day. Collectively, these factors have fostered a risk-on sentiment that continues to negatively impact the US Dollar.

Despite the release of negative economic data, such as declining retail sales and rising weekly jobless claims, which could have supported the US Dollar, the greenback failed to capitalize on these developments.

The US Dollar Index, which measures the performance of the US Dollar against a basket of six major currencies, fell to 108.91, compared to the previous day’s close of 109.09. The index reached a daily high of 109.38 and a low of 108.87.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations