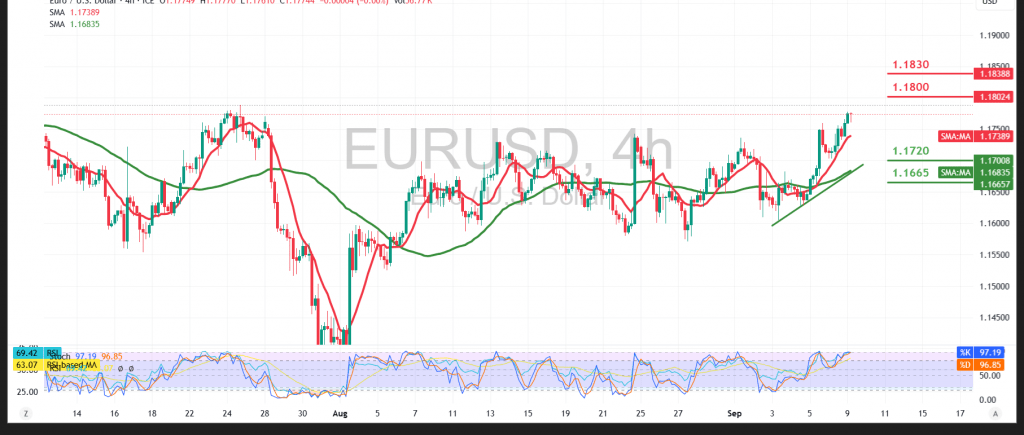

The EUR/USD pair extended its upward momentum in line with the previous report’s positive outlook, breaking through the key resistance at 1.1760 and reaching a high of 1.1778.

Technical Outlook – 4-hour timeframe:

Intraday price action remains bullish, supported by stability above the ascending trend line. The 50-period simple moving average continues to act as dynamic support, reinforcing the positive structure. Meanwhile, the Relative Strength Index (RSI) is still issuing bullish signals, though its position in overbought territory may temporarily slow momentum without negating the prevailing trend.

Probable Technical Scenario:

As long as the pair holds above 1.1720—and more importantly above 1.1700—the bullish scenario remains dominant. A confirmed break above the psychological resistance at 1.1800 would strengthen upside momentum and open the path toward higher resistance levels shown on the chart.

Conversely:

A sustained move back below the cited support levels would expose the pair to renewed selling pressure, with downside targets near 1.1665.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1715 | R1: 1.1800 |

| S2: 1.1665 | R2: 1.1830 |

| S3: 1.1630 | R3: 1.1885 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations