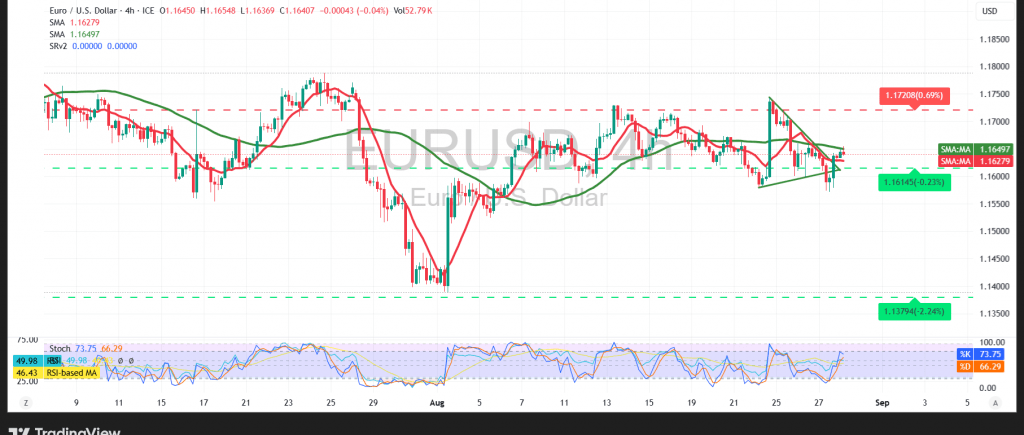

The EUR/USD pair came under negative pressure in the previous session after failing to sustain stability above the psychological support highlighted in our last report, recording a low of 1.1574.

Technical Outlook – 4-hour timeframe:

The pair rebounded higher after regaining stability above the 1.1600 level. However, despite this recovery, the Relative Strength Index (RSI) has entered overbought territory, suggesting limited upside potential. Selling pressure also persists, with the price still trading below the 50-period simple moving average, which continues to act as dynamic resistance and may obstruct further upward momentum.

Preferred Technical Scenario:

As long as the pair remains below the 1.1665 resistance, the bearish trend remains the most likely scenario. Confirmation of a move back below 1.1600 would strengthen this outlook, targeting 1.1550 as initial support, followed by 1.1520 as the next key level.

Conversely:

A confirmed hourly close above 1.1665 could spark a short-term reversal, paving the way for a retest of 1.1690, with further upside potential toward 1.1730.

Fundamental Note:

Traders are awaiting high-impact US economic data today, including preliminary GDP (QoQ) and weekly unemployment claims. These releases may generate heightened volatility in price action.

Warning: Risks remain high amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1595 | R1: 1.1665 |

| S2: 1.1550 | R2: 1.1690 |

| S3: 1.1520 | R3: 1.1740 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations