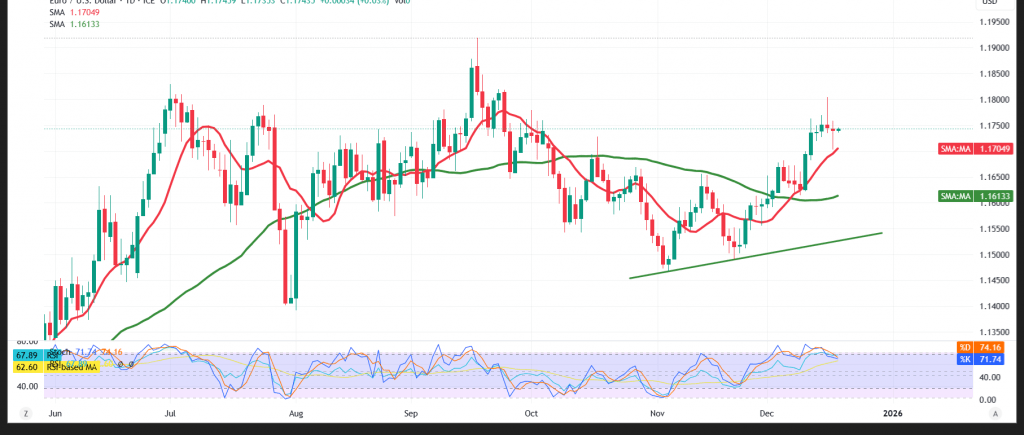

The EUR/USD pair continues its gradual upward trend, reaching a high of 1.1758 during the previous session.

Technical Outlook – 4-Hour Timeframe:

The pair has formed solid support near the psychological level of 1.1700, supported by continued trading above the simple moving averages, which are acting as dynamic support. Price action also remains aligned with an ascending trendline, reinforcing the positive bias.

However, the Relative Strength Index (RSI) has started to lose upward momentum, which may expose the pair to temporary downward pressure before any renewed advance.

Likely Technical Scenario:

A break above the 1.1780 resistance level could open the way for further gains toward 1.1820, followed by 1.1845. On the other hand, a confirmed break below 1.1700 would put the pair under downside pressure, targeting 1.1675 initially, then 1.1640.

Warning: Today we await high-impact economic data, including the U.S. core CPI (monthly and annual) and weekly unemployment claims. From the Eurozone, attention is on the ECB interest rate decision, monetary policy statement, and press conference. From the UK, markets await the interest rate decision and monetary policy summary. Elevated price volatility is expected around these events.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1710 | R1: 1.1780 |

| S2: 1.1675 | R2: 1.1820 |

| S3: 1.1640 | R3: 1.1855 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations