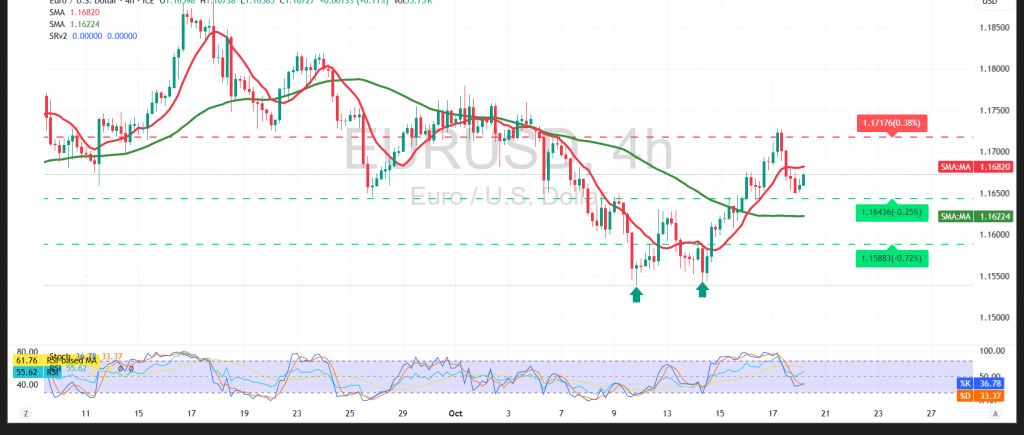

EUR/USD met the prior report’s first upside target at 1.1720 before stalling; price now trades below 1.1720, keeping it a pivotal near-term resistance despite the intraday bid.

Technical:

While the broader structure remains down, an intraday bullish sub-trend is developing. SMAs continue to act as dynamic support beneath price. RSI has rotated up from oversold, raising the risk of positive divergence. A nascent double-bottom pattern further argues for a corrective push higher if resistance yields.

Base case:

Holding above 1.1640 favors a corrective advance. A clean break through 1.1720 would likely unlock 1.1760 as the next upside objective.

Alternative:

A decisive break below 1.1640 on an hourly close would re-establish downside pressure, opening 1.1600 initially.

Risk:

Trade/geopolitical headlines can trigger abrupt swings. Use disciplined sizing and clear invalidation levels; this setup may not suit all risk profiles.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1640 | R1: 1.1720 |

| S2: 1.1600 | R2: 1.1760 |

| S3: 1.1560 | R3: 1.1795 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations