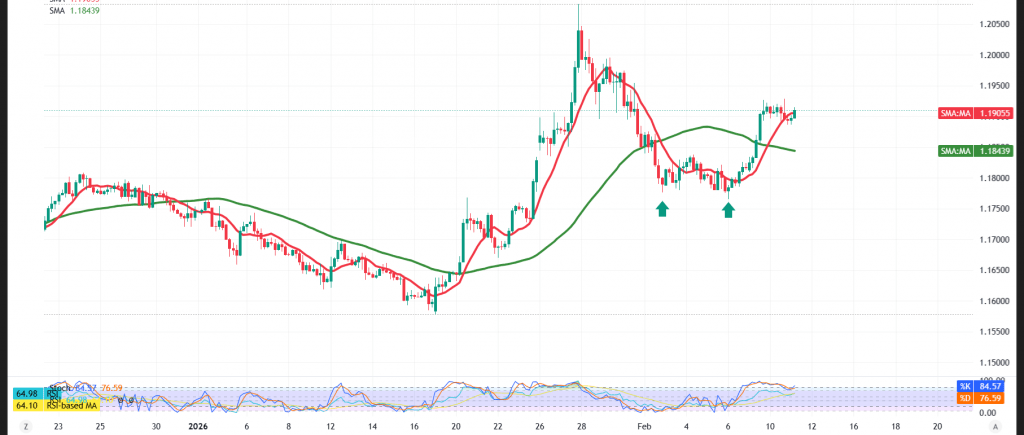

The EUR/USD pair is moving sideways with a slight upward bias, as it attempts to overcome the key psychological resistance at the 1.1900 level.

Technical Outlook – 4-Hour Chart

Momentum indicators are leaning constructive. The Relative Strength Index (RSI) is hinting at a potential positive divergence, while price action continues to hold above the simple moving averages, which are providing dynamic support. In addition, the bullish technical pattern visible on the chart further supports the upside scenario.

Most Likely Technical Scenario

As long as trading remains above the 1.1870 level — and more broadly above the 1.1840 support zone — the bullish bias remains intact, with 1.1950 standing as the primary upside target. A confirmed break above this pivotal resistance could extend gains toward a retest of the 1.1970 area.

On the downside, a sustained close below 1.1840 would invalidate the bullish setup and place the pair under renewed pressure, potentially triggering a pullback toward 1.1765.

Market Warning:

High-impact U.S. economic data is due today, including Non-Farm Payrolls, the unemployment rate, and average hourly earnings. Elevated volatility is expected around the release, which could drive sharp price swings.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1840 | R1: 1.1955 |

| S2: 1.1765 | R2: 1.2000 |

| S3: 1.1720 | R3: 1.2070 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations