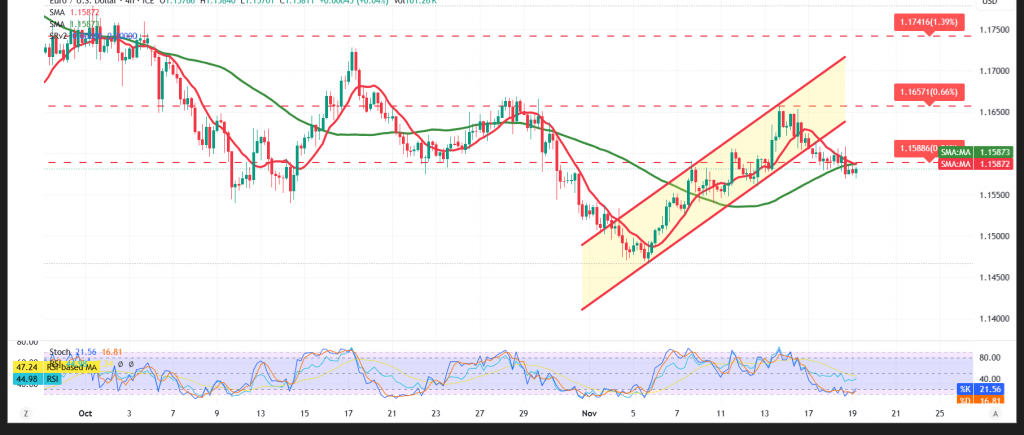

The pair remains range-bound below 1.1600, failing to hold above the psychological barrier.

Technical outlook

- Structure/SMAs: A break below the prior ascending channel plus SMAs turning overhead shifts bias lower.

- Momentum: Indicators are starting to lean bearish, consistent with fading upside.

Base case (bearish trigger)

- A decisive break/4H close below 1.1580 would likely open 1.1550, then 1.1520.

Alternative / upside toggle

- Reclaiming and holding above 1.1600, and more convincingly 1.1620, would put a recovery toward 1.1670 back on the table.

Event risk

- FOMC minutes today could spark volatility; consider tighter risk controls around the release.

Risk note

Headline risk is elevated. Use prudent sizing and firm stops; reassess quickly if trigger levels give way.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1580 | R1: 1.1620 |

| S2: 1.1550 | R2: 1.1665 |

| S3: 1.1520 | R3: 1.1705 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations