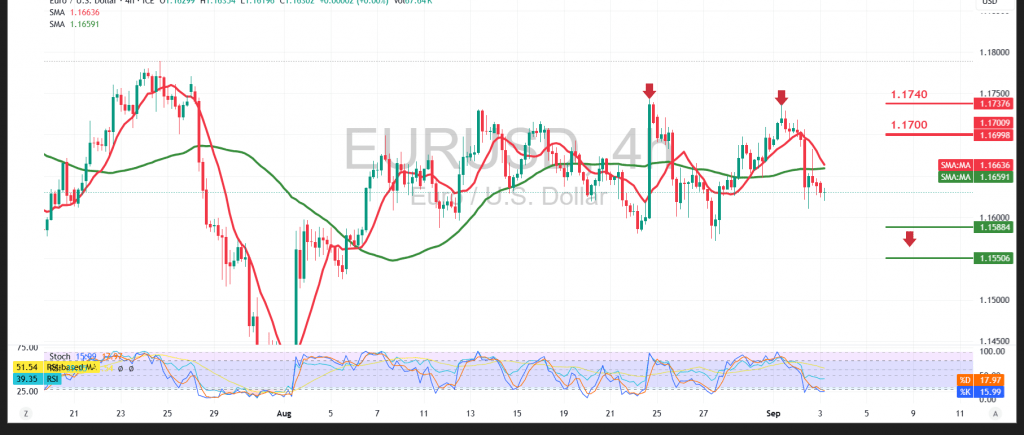

The EUR/USD pair is facing strong selling pressure after failing to sustain stability above the psychological resistance at 1.1700, which acted as a firm barrier and pushed the price back into a negative trajectory.

Technical Outlook – 4-hour timeframe:

Intraday price action reflects a bearish bias, with the pair trading below the simple moving averages that have now shifted into dynamic resistance. Although the Relative Strength Index (RSI) is attempting to recover from oversold conditions, bearish pressure remains the dominant force.

Probable Technical Scenario:

As long as trading remains below 1.1700, the bearish outlook is favored, with attention on the 1.1590 support level. A confirmed break below this area could open the way for a deeper decline toward subsequent support levels.

Conversely:

A confirmed hourly close above 1.1700 could alter the short-term technical outlook and trigger a recovery attempt, with the potential for a retest of the resistance levels highlighted on the chart.

Fundamental Note:

Today’s session features high-impact US economic data, including job openings and labor turnover (JOLTS). These releases may drive heightened price volatility.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1585 | R1: 1.1695 |

| S2: 1.1545 | R2: 1.1760 |

| S3: 1.1485 | R3: 1.1800 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations