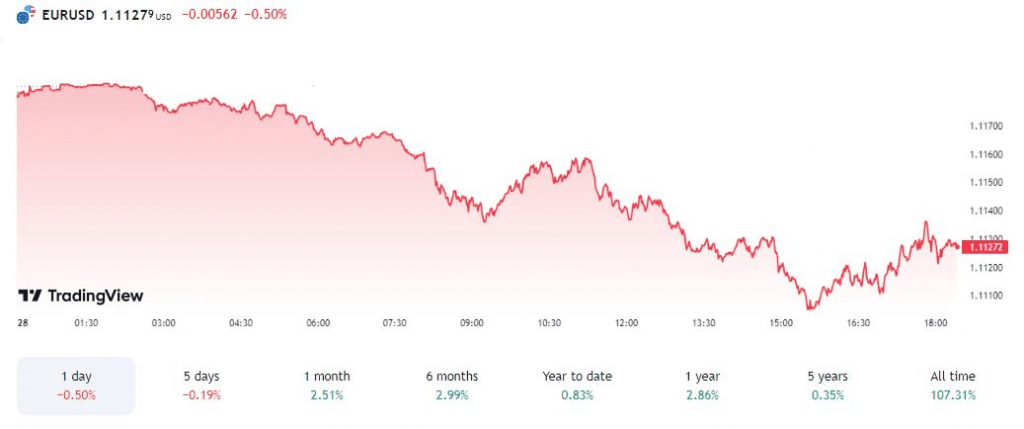

The Euro has faced a tumultuous week, with its value against the US Dollar fluctuating significantly. This volatility can be attributed to a confluence of factors, including the European Central Bank’s (ECB) monetary policy stance, economic indicators, and market sentiment. The EUR/USD pair is trading at 1.1128 at the time of writing; down 050% on the day.

ECB Rate Cut Expectations

The ECB has been gradually reducing interest rates in response to slowing inflation. Market participants are increasingly confident that the central bank will implement another rate cut in September, potentially followed by additional reductions later in the year. This expectation has weighed on the Euro, as lower interest rates generally make a currency less attractive to investors.

Economic Indicators

Recent economic data from the Eurozone has painted a mixed picture. While some indicators suggest that inflationary pressures are easing, others point to a weakening economic outlook. The flash Harmonized Index of Consumer Prices (HICP) data for August, due to be released this week, will be closely watched for clues about the trajectory of inflation.

Market Sentiment and Volatility

The futures market has seen a shift in positioning for the Euro. While there was a reduction in EUR longs last year, current positioning is relatively small. This suggests that market participants are not overly bullish on the Euro’s prospects.

Risk reversals, a measure of market sentiment, have also been volatile. The recent appreciation of the Euro has pushed up both realized and implied volatility. However, as the spot rate stabilizes, risk reversals are expected to return to more neutral levels.

The Euro’s future direction will depend on a number of factors, including the ECB’s monetary policy decisions, economic data releases, and market sentiment. The ongoing volatility in the EUR/USD pair reflects the uncertainty surrounding these factors. Investors will be closely monitoring developments in the coming weeks and months to gauge the Euro’s prospects.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations