Since the risk-off sentiment has subsided, the EUR/USD pair is attempting to retake the 1.0700 barrier. Resurgence of German inflation has strengthened the case for continuing the 50 bps rate hike, so the Fed doesn’t need to be in a rush to end the period of tightening policy.

After failing to retake the round-level resistance of 1.0700 in the late New York session, the EUR/USD pair has since moved sideways. The major currency pair is anticipated to retake the barrier noted above as the risk-off sentiment has subsided as expectations of a Chinese revival following the release of the Caixin Manufacturing PMI eclipsed the possibility of a global recession.

The S&P 500 saw some losses on Wednesday as Federal Reserve (Fed) members gave hawkish interest rate outlook. The US Dollar Index (DXY) has dropped to just around 104.00 after failing to rise over 104.20, reflecting a mixed market sentiment. The 10-year US Treasury yields increased to 4% as a result of the continued lacklustre demand for US government assets.

Raphael Bostic, president of the Atlanta Fed, predicted that because the US Consumer Price Index (CPI) is so sticky, the central bank would raise the terminal rate to a range between 5.00% and 5.25%. In addition, the Fed policymaker anticipates that the central bank would maintain the increased terminal rate at a stable level through 2024.

The US ISM Manufacturing PMI report stated that inflationary pressures have returned and that the Fed should not be rushing to end its current period of tightening monetary policy. In spite of the Fed raising interest rates, the Manufacturing PMI declined for a fourth straight month. The economic statistics came in at 47.7, under the consensus estimate of 48.0.

The New Orders Index increased from 43.7 expected and 42.5 in the previous release to 47.0, indicating a very strong forward demand.

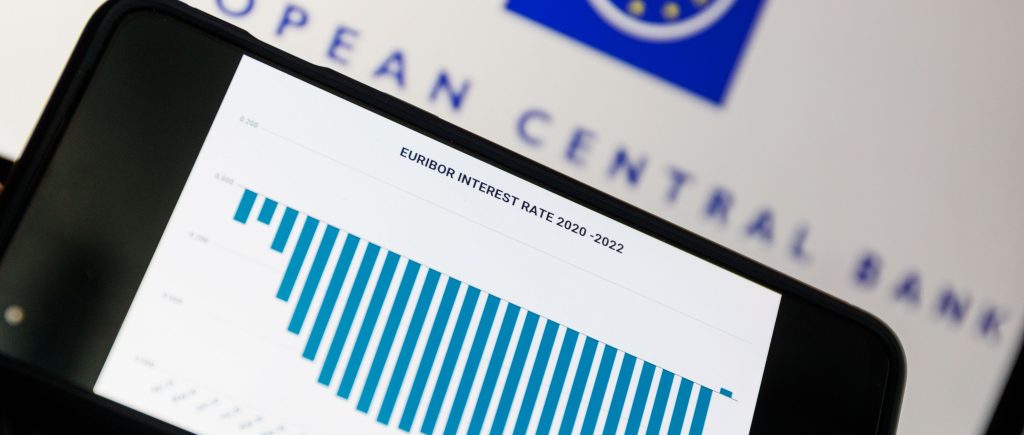

The German Harmonized Index of Consumer Prices (HICP), which was stronger than expected, revealed that the European Central Bank (ECB) has several obstacles on the way to achieving price stability. The German HICP increased from the previous publication of 9.2% and estimates of 9.0% to 9.3%. ECB President Christine Lagarde has already stated that the institution intends to raise interest rates by an additional 50 basis points in its March monetary policy.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations