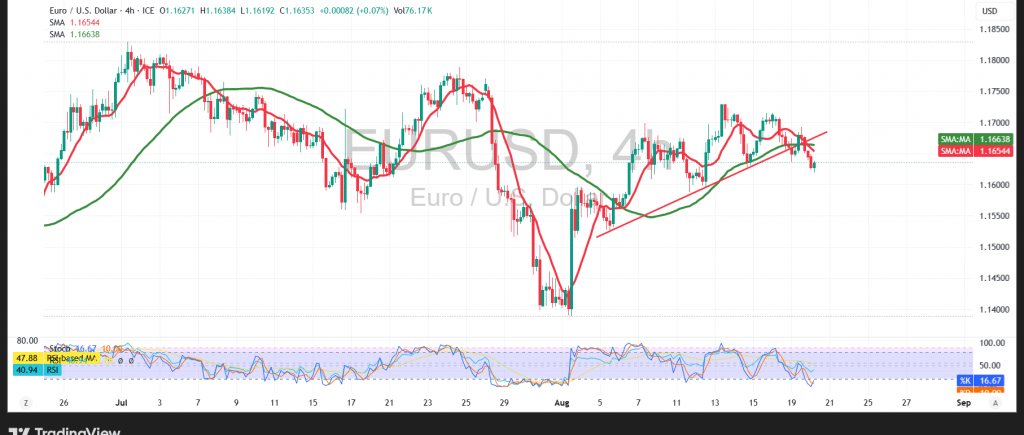

The EUR/USD pair has been dominated by a bearish trend after failing to close above the psychological resistance level of 1.1700.

Technical Outlook – 4-Hour Timeframe:

Technical indicators are signaling a negative bias. The 50-day Simple Moving Average (SMA) continues to exert downward pressure, supported by negative signals from the Relative Strength Index (RSI). The clear break below the minor ascending trendline further reinforces the sellers’ dominance, as is evident on the chart.

Probable Scenario:

Bullish Scenario: As long as the pair remains stable below 1.1680, and generally below the psychological barrier of 1.1700, the bearish trend is most likely to prevail today. Initial targets are at the first support level of 1.1605. A break below this level would open the door for further declines towards 1.1575.

Bearish Scenario: A clear breakout and consolidation above 1.1700 could give the pair some positive momentum to trim its losses, with a potential temporary reversal toward 1.1720 and then 1.1760, which are key resistance areas.

Fundamental Note:

• High-Impact Data: Today, we are awaiting high-impact economic data from the U.S. economy—the Federal Reserve’s FOMC Meeting Minutes. This data could cause strong price volatility upon its release.

Warning: The risk level remains high amid ongoing trade tensions, and all scenarios could be possible.

Risk Disclaimer: Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.0605 | R1: 1.1675 |

| S2: 1.1575 | R2: 1.1720 |

| S3: 1.1530 | R3: 1.1760 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations