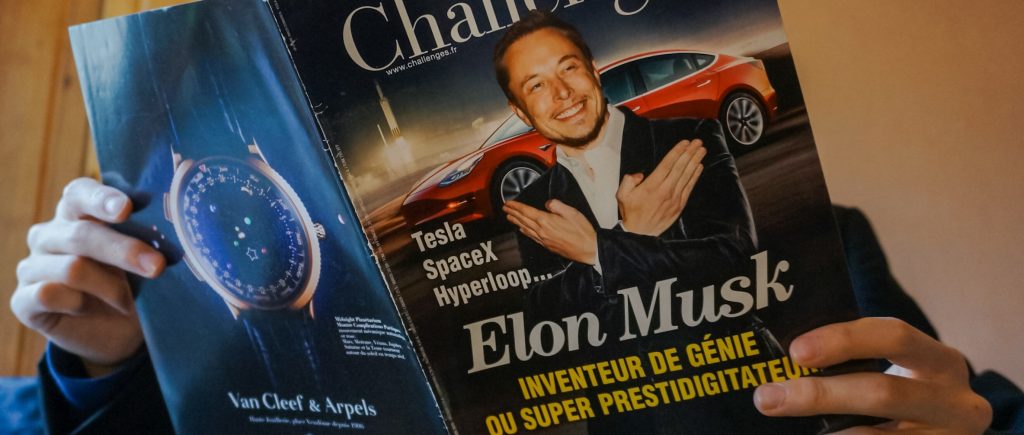

The “Big Short” movie star Michael Burry returned to Twitter Friday. After earlier remarks about inflation, SEC and Fed policies, the movie star who is also CEO of Scion Asset Management says that Elon Musk has wrong calculations and had it not quite right with his Rivian comments.

Earlier in the week, Burry commented on the CEO of Tesla’s twitter poll saying that Elon Musk’s personal loans were probably the real reason why he needed to sell stocks.

The investor made famous by “Big Short” has issued dire warnings about the state of the stock market. Michael Burry warns that stock market speculation has reached levels not seen since before the 1929’s financial crash.

Burry claims that assets are more over-valued than before the dot-com bubble burst. He also worries that geopolitical and economic conflicts exceed the levels of the 1970s.

Burry’s concern appears to be that the globe is fast moving towards an economic calamity, and government regulators such as the Securities and Exchange Commission and the Federal Reserve are taking no action to prevent such hazards.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations