The recent release of the August 2024 Consumer Price Index (CPI) report has provided valuable insights into the current state of inflation in the United States. While the headline inflation rate has continued its downward trajectory, underlying inflationary pressures persist, raising questions about the Federal Reserve’s future monetary policy decisions.

Key Findings from Today’s CPI Report

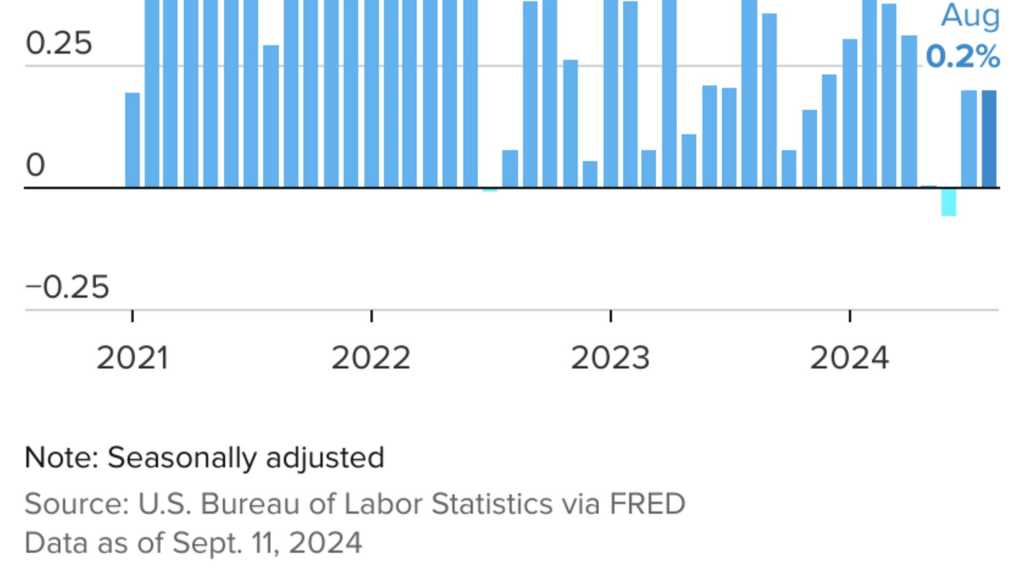

Moderate Overall Inflation: The overall CPI increased by 0.2% in August, bringing the annual inflation rate to 2.5%. This represents a significant decline from the peak levels experienced in 2023 and suggests that the Federal Reserve’s aggressive interest rate hikes have begun to have a cooling effect on the economy.

Persistent Core Inflation: However, the core CPI, which excludes volatile food and energy prices, rose by 0.3% in August. This indicates that inflationary pressures are still present within the broader economy, particularly in areas such as housing, healthcare, and services.

Housing Costs Remain Elevated: The shelter component of the CPI, which accounts for a significant portion of the overall index, continued to climb at a steady pace. This suggests that housing costs remain a major contributor to inflation and may continue to put upward pressure on prices in the coming months.

Mixed Performance in Other Categories: While food prices remained relatively stable, energy costs experienced a decline. Other categories, such as used vehicle prices and medical care services, exhibited mixed performance.

Inflation Tamed, Not Vanquished:

The August inflation reading is down significantly from the 9.1% pandemic-era peak in mid-2022, which was the highest level since 1981. It’s also nearing policymakers’ long-term target of around 2%. Overall, inflation appears to have been successfully tamed, but, with housing inflation still refusing to moderate as quickly as hoped, it hasn’t been completely vanquished.

Implications for Fed

The latest CPI report presents a mixed picture for the Federal Reserve. On the one hand, the decline in overall inflation is a positive sign, suggesting that the central bank’s monetary policy measures are working. However, the persistence of core inflation and elevated housing costs raises concerns about the potential for inflation to rebound.

As a result, the Federal Reserve is likely to remain cautious in its approach to interest rate cuts. While the central bank may gradually reduce interest rates to support economic growth, it is expected to closely monitor inflation developments and adjust its policy stance as needed.

Factors Affecting Inflation

Several factors are influencing the current inflation environment:

Supply Chain Disruptions: The ongoing recovery from the COVID-19 pandemic has led to supply chain disruptions and shortages of certain goods, contributing to higher prices.

Strong Labor Market: A tight labor market with low unemployment rates has put upward pressure on wages, which can lead to higher prices for goods and services.

Geopolitical Factors: Global events such as the war in Ukraine and trade tensions between the United States and China can impact commodity prices and supply chains, affecting inflation.

Monetary Policy: The Federal Reserve’s monetary policy decisions, including interest rate changes and asset purchases, play a crucial role in influencing inflation.

Outlook for Inflation

While the current inflation rate has declined from its peak, it remains above the Federal Reserve’s target of 2%. It is important to monitor the trajectory of inflation closely, as any resurgence could necessitate further tightening of monetary policy.

Several factors will influence the future path of inflation, including the evolution of supply chains, the labor market, and global economic conditions. Additionally, the Federal Reserve’s policy decisions will play a critical role in determining whether inflation can be successfully brought back to a sustainable level.

The August 2024 CPI report provides valuable insights into the current state of inflation in the United States. While the overall inflation rate has declined, underlying inflationary pressures persist, raising questions about the Federal Reserve’s future monetary policy decisions. As the economy continues to navigate the challenges of recovery and global events, the trajectory of inflation will remain a key focus for policymakers and investors.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations