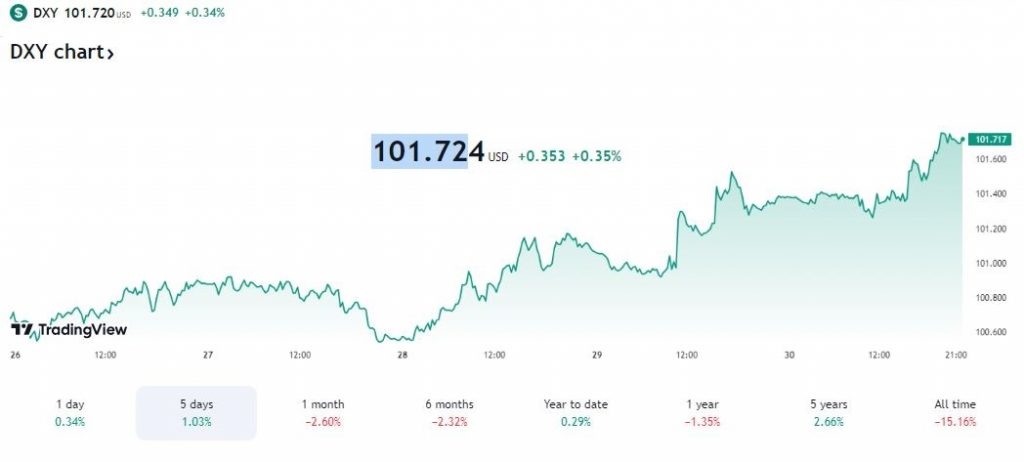

The US Dollar has been on a steady upward trajectory, gaining strength following the release of July’s Personal Consumption Expenditures (PCE) Index. This inflation metric, favored by the Federal Reserve, has shown a consistent decline, suggesting that inflationary pressures are easing. However, the path forward for interest rate cuts remains uncertain, hinging on the upcoming labour market data. The Dollar Index, DXY, is up 0.35%, trading at 101.724 at the time of writing.

The US Dollar’s recent gains can be attributed to the moderating inflation rates as measured by the PCE Index. While the Federal Reserve is expected to cut interest rates, the extent of these cuts will depend on the performance of the labour market. Technically, the DXY is showing signs of strength, but a sustained break above key resistance levels is necessary to confirm a more significant uptrend. As the economic landscape continues to evolve, investors will closely monitor both inflationary trends and labour market data to gauge the future direction of the US Dollar.

Inflationary Trends and Rate Cut Expectations

The PCE Price Index, both headline and core, came in below market expectations for July, indicating that inflation is gradually moderating. This has reinforced the anticipation of interest rate cuts by the Federal Reserve, with the central bank’s chairman already hinting at a reduction in September. However, the extent of these cuts remains a topic of debate, with a 50-basis-point reduction now less likely.

The Labour Market’s Influence

While the inflationary outlook is improving, the labour market continues to play a crucial role in determining the Fed’s monetary policy stance. The strength of the job market could influence the pace and magnitude of interest rate cuts. A robust labour market might necessitate more gradual reductions to prevent inflationary pressures from resurfacing.

Technical Outlook:

From a technical perspective, the US Dollar Index (DXY) has exhibited bullish momentum, suggesting a potential recovery. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators are pointing towards a positive trend. However, the overall outlook remains negative, and a sustained break above the 20-day Simple Moving Average (SMA) at 102.00 would be required to confirm a more significant uptrend.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations