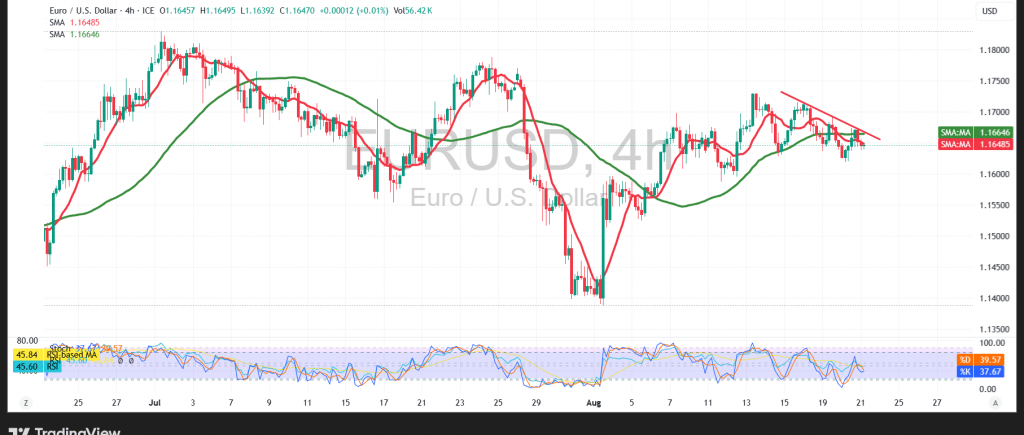

The downward trend continues to dominate the movements of the EUR/USD pair during the previous trading session, with the pair recording its highest level around the 1.1670 resistance.

Technical Outlook – 4-Hour Timeframe:

Technical indicators are still providing negative signals. The 50-day Simple Moving Average continues to exert additional negative pressure, supported by negative signals from the Relative Strength Index after selling off from the overbought area. Additionally, the price is moving along a downward trendline, as shown on the chart.

Probable Scenario:

Bullish Scenario: As long as the pair remains stable below the 1.1680 level, and generally below the psychological barrier of 1.1700, the downward trend is most likely to dominate today’s trading. Targets start at the first support level of 1.1620. A break of this level would open the way for further declines toward 1.1575.

Bearish Scenario: A clear breakout and consolidation above 1.1700 could give the pair some positive momentum to trim its losses, with a potential temporary reversal toward the 1.1720 and then 1.1760 levels, which represent key resistance areas.

Fundamental Note:

On Thursday, we are awaiting high-impact economic data from the US economy: “Weekly Unemployment Claims, Preliminary Reading of the Services and Manufacturing PMI.” This data may cause strong price volatility when released.

Warning: The risk level is high amid ongoing trade tensions, and all scenarios may be plausible.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.0605 | R1: 1.1675 |

| S2: 1.1575 | R2: 1.1720 |

| S3: 1.1530 | R3: 1.1760 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations