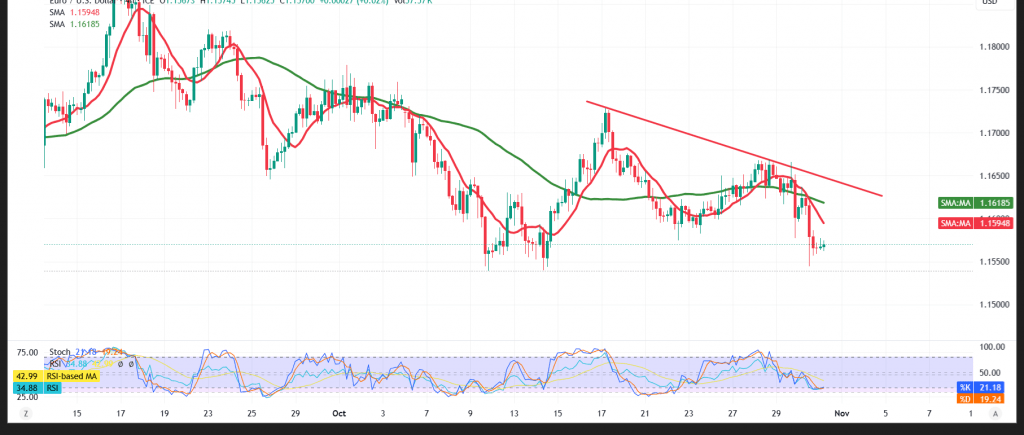

The pair staged a modest intraday bounce after testing the 1.1550 support zone.

Technical outlook (4H):

• RSI is attempting to unwind oversold conditions, showing early stabilisation.

• Price action remains capped by descending trendline resistance, and the 50/100 SMAs continue to act as dynamic hurdles, preserving downside pressure.

Base case:

• While below 1.1600 (and more broadly 1.1620), the path of least resistance remains lower.

• A clean break and 4H close beneath 1.1550 would open 1.1500, then 1.1450.

Alternative:

• Sustained traction back above 1.1600/1.1620 would neutralise immediate downside risk and allow a corrective push toward 1.1675.

Risk note:

Volatility risk is elevated amid ongoing trade tensions; scenario probabilities can shift quickly. Manage position size and stops accordingly.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1535 | R1: 1.1625 |

| S2: 1.1495 | R2: 1.1675 |

| S3: 1.1445 | R3: 1.1720 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations