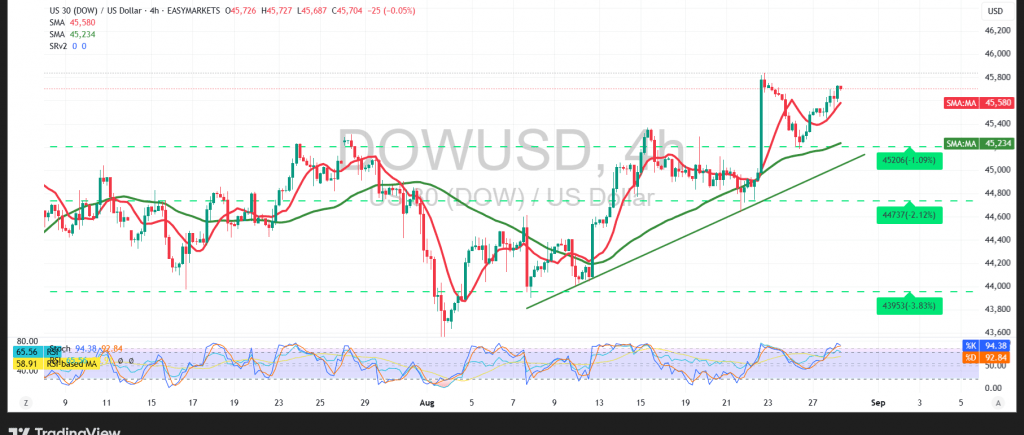

The Dow Jones Industrial Average (DJI30) moved in line with prior expectations, extending its upward momentum toward the first target at 45,645, coming close to the next resistance at 45,770, and posting a session high of 45,735.

Technical Outlook – 4-hour timeframe:

The 50-period simple moving average continues to support the bullish trend, while the Relative Strength Index (RSI) is generating positive signals that reinforce the strength of upward momentum. Overall, the trend remains tilted to the upside as long as the price holds above key support levels.

Probable Scenario:

As long as the index maintains stability above 45,525, the bias remains bullish, with 45,810 as the first resistance. A confirmed break above this level could pave the way for further gains toward 45,900. Conversely, an hourly close below 45,520 would likely bring back selling pressure, exposing the index to a decline toward 45,340.

Fundamental Note:

Today’s session features high-impact US economic data releases, including the preliminary quarterly GDP report and weekly unemployment claims. These announcements may trigger significant market volatility.

Warning: Risks remain high amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 45520 | R1: 45810 |

| S2: 45340 | R2: 45920 |

| S3: 45230 | R3: 46095 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations