The Dow Jones Industrial Average traded with a positive bias on Wall Street, posting a high of 46,655.

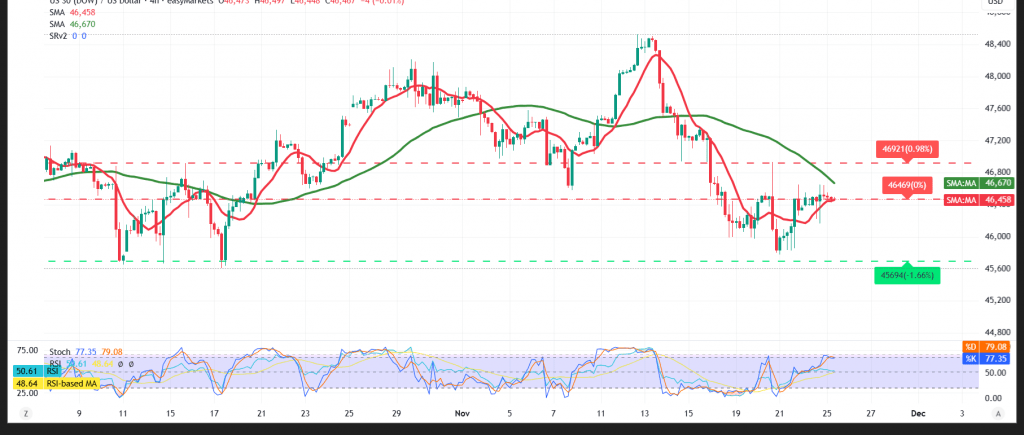

Technical Outlook – 4-Hour Timeframe

The 50-period Simple Moving Average (SMA) continues to support the prevailing daily uptrend, reinforcing the bullish structure. At the same time, the RSI is attempting to generate fresh positive signals on short-term timeframes, which may further bolster upside momentum.

Most Likely Scenario

As long as daily trading holds above 46,230, and more broadly above 46,200, the outlook remains tilted to the upside. A confirmed break of the 46,655 resistance level could open the way for an advance toward 46,690, followed by 46,900.

On the other hand, a clear and sustained break below the 46,200 support zone would expose the index to additional downside pressure, potentially triggering a move toward 45,930.

Caution

The risk level is elevated and may not be appropriate relative to the potential return for some investors.

Warning

Highly significant U.S. economic data is due today, particularly the monthly and annual Producer Price Index (PPI), which could provoke sharp volatility around the time of release. Risk levels remain high amid ongoing trade and geopolitical tensions, keeping multiple scenarios in play.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 46200 | R1: 46690 |

| S2: 45930 | R2: 46920 |

| S3: 45715 | R3: 47185 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations