The Dow Jones Industrial Average (DJIA) extended its gains on Wall Street, reaching a high of 47,671.

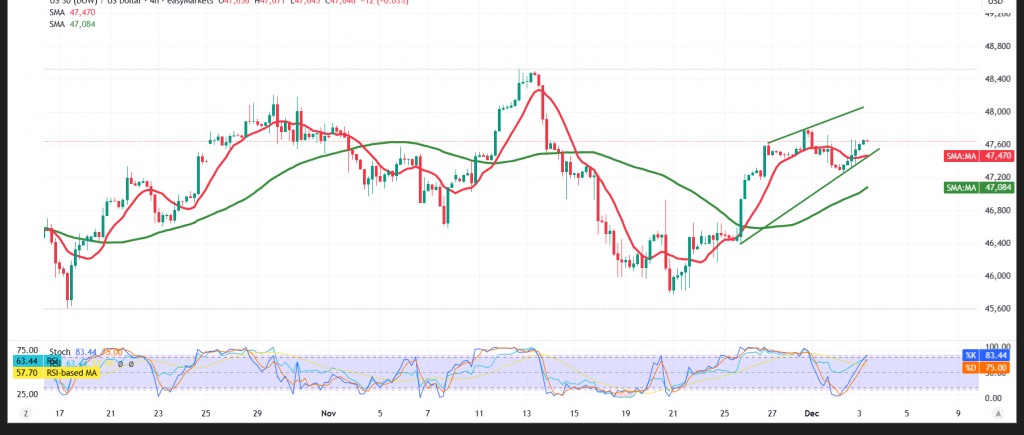

Technical Outlook – 4-Hour Timeframe:

The 50-period Simple Moving Average (SMA) continues to support the broader upward trend and provides consistent positive momentum. The Relative Strength Index (RSI) is also delivering positive signals, confirming the strength of the current bullish movement.

Likely Scenario:

As long as the index holds above 47,530, the upward bias remains valid. A break above the resistance level of 47,670 could open the door for additional gains toward 47,795, with an extended target near 47,930.

Conversely, a confirmed break below the support level of 47,395 would put direct downward pressure on the index, paving the way for a move toward 47,130.

Caution: The risk level is high and may not be suitable for all investors.

Warning: Highly impactful U.S. economic data is expected today, specifically the Non-Farm Private Employment Change and the ISM Purchasing Managers’ Index (PMI). Significant price volatility is likely around the time of release.

Warning: Risk remains elevated amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 47395 | R1: 47795 |

| S2: 47130 | R2: 47935 |

| S3: 46990 | R3: 48200 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations