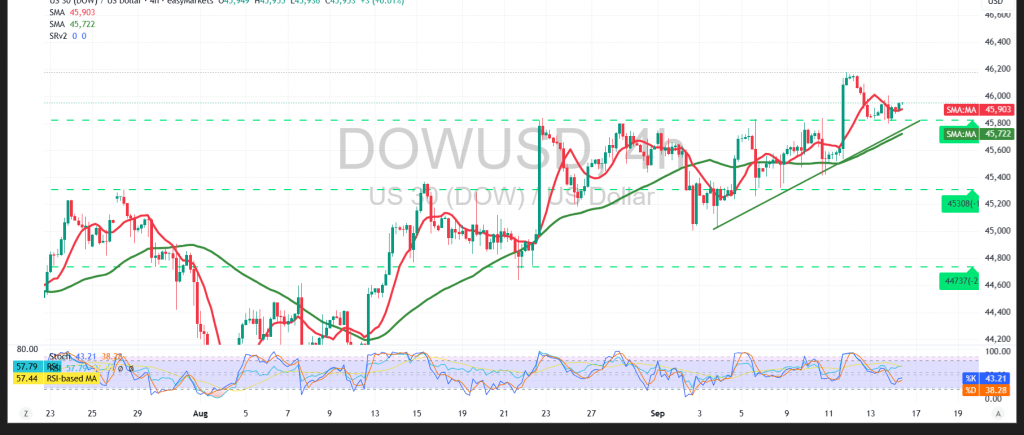

The Dow Jones Industrial Average extended its rally on Wall Street, recording a new all-time high of 46,008.

Technical Outlook – 4-hour timeframe:

The 50-period simple moving average (SMA) continues to underpin the bullish momentum, acting as a dynamic support for price action. Meanwhile, the Relative Strength Index (RSI) is issuing positive signals on short-term timeframes, reflecting sustained efforts by buyers to push the index higher.

Likely Scenario:

Holding above the 45,830 support level is essential to preserving the short-term bullish bias. A confirmed break above 46,040 could accelerate gains, opening the way toward 46,125, followed by 46,240 as successive resistance levels.

Conversely:

A move back below 45,825 would introduce renewed selling pressure, potentially leading to a retest of the next support zone near 45,710.

Fundamental Note:

Today’s session includes key U.S. economic data (retail sales) and Canada’s Consumer Price Index (CPI) on both annual and monthly readings. These releases could trigger heightened volatility in equity markets.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 45825 | R1: 46040 |

| S2: 45705 | R2: 46125 |

| S3: 45620 | R3: 46245 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations