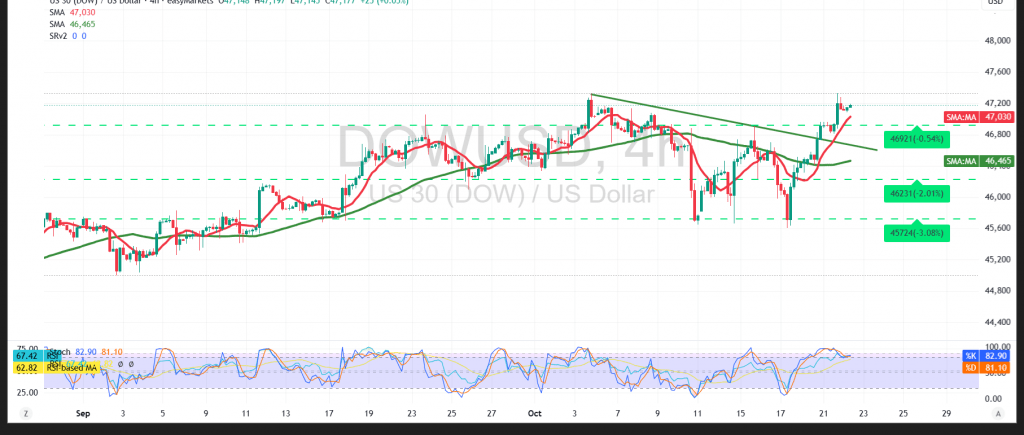

The Dow Jones Industrial Average extended its advance, exceeding the prior target at 47,160 and printing a high at 47,355, keeping the near-term tone constructive.

Technical:

The 50-period SMA continues to provide a positive impulse, underpinning dips on the 4-hour chart. RSI is holding above the 50 midline, confirming short-term bullish momentum and supporting further topside probes.

Base case (bullish continuation):

A confirmed break above 47,355 would likely extend gains toward 47,405 initially, with scope to 47,530 on follow-through buying.

Alternative (pullback risk):

A decisive break below 46,885 would weaken the intraday bullish tone and expose 46,585 as the next downside objective.

Risk:

Given headline and geopolitical sensitivities, swings can be abrupt and risk–reward may be uneven. Employ disciplined sizing, clear invalidation levels, and avoid overexposure around event risk.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 46885 | R1: 47405 |

| S2: 46585 | R2: 47630 |

| S3: 46365 | R3: 47925 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations