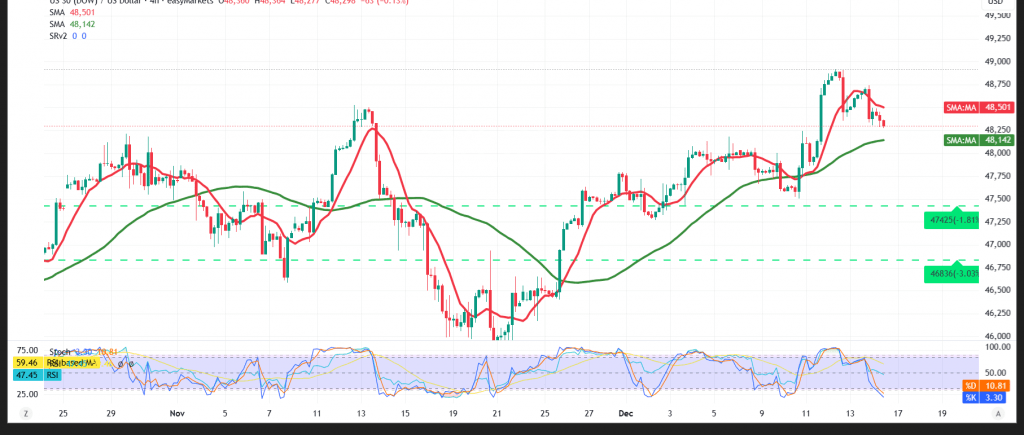

The Dow Jones Industrial Average posted losses during the previous trading session after reaching a high of 48,745.

Technical Outlook – 4-Hour Timeframe:

The 50-period Simple Moving Average (SMA) has started to apply downward pressure on the index, increasing short-term negative momentum. At the same time, the Relative Strength Index (RSI) is turning lower, signaling a loss of bullish momentum.

Likely Scenario:

As long as daily trading remains below the 48,540 resistance level, the index may be exposed to further downside, with a potential retest of 48,145. Conversely, a return to trading above 48,540 could support a recovery move toward 48,610, followed by 48,680.

Note: Today, markets are awaiting high-impact US economic data, including non-farm payrolls, average earnings, unemployment rates, and the preliminary readings of the manufacturing and services Purchasing Managers’ Index (PMI). Elevated price volatility is expected around the release times.

Warning: The level of risk remains high and may not be commensurate with potential returns.

Warning: Heightened trade and geopolitical tensions continue to elevate risk levels, and all scenarios remain possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 48145 | R1: 48610 |

| S2: 47975 | R2: 48910 |

| S3: 47675 | R3: 49080 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations