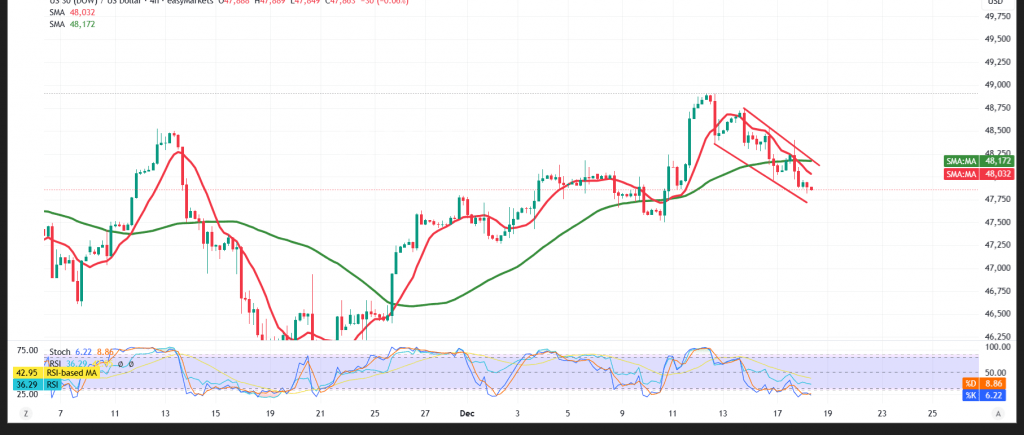

The Dow Jones Industrial Average extended its downward trend in line with our negative outlook, reaching the targeted level of 48,145 and recording a low of 47,818.

Technical Outlook for Today’s Session – 4-Hour Timeframe:

The 50-period Simple Moving Average (SMA) is now exerting clear downward pressure, reinforcing the short-term bearish bias.

The Relative Strength Index (RSI) continues to generate negative signals, indicating fading upward momentum.

Likely Scenario:

As long as daily trading remains below the 48,250 resistance level, the downside scenario remains more likely, with the next target seen near 47,655. However, a recovery above this resistance level could prompt a corrective rebound toward 48,620.

Note: Today we await high-impact US economic data, including the annual and monthly core Consumer Price Index (CPI) and weekly jobless claims. From the Eurozone, markets are anticipating the ECB press conference, interest rate decision, and monetary policy statement. From the UK, the interest rate decision and monetary policy summary are due. Elevated price volatility is expected around these releases.

Note: The level of risk is high and may not be commensurate with potential returns.

Note: Elevated risks persist amid ongoing trade and geopolitical tensions, and all scenarios remain possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 47655 | R1: 48240 |

| S2: 47445 | R2: 48620 |

| S3: 47070 | R3: 48830 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations