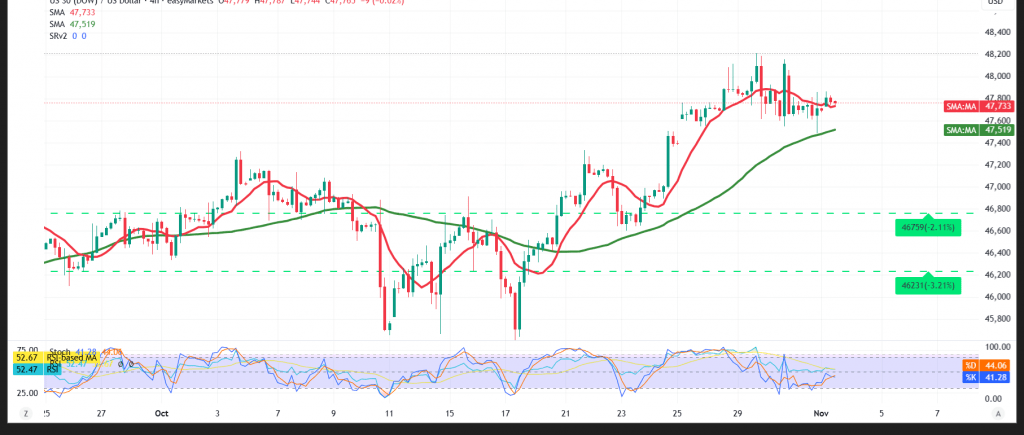

Price action has been choppy, but a short-term upward rebound has emerged.

Technical outlook

- 50-SMA (4H): Continues to underpin price.

- RSI: Back above 50, signaling improving momentum.

Base case (intraday bullish trigger)

- A clear break and hold above 47,800 would tilt bias higher toward 47,850, then 47,920.

Alternative / downside

- Failure to reclaim 47,800 and a move back below 47,710 would increase pressure for a dip to 47,650.

Risk note

Volatility is elevated and may be disproportionate to potential returns. Use prudent sizing and firm stops; reassess quickly if these levels break.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 47710 | R1: 47850 |

| S2: 47650 | R2: 47930 |

| S3: 47570 | R3: 48000 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations