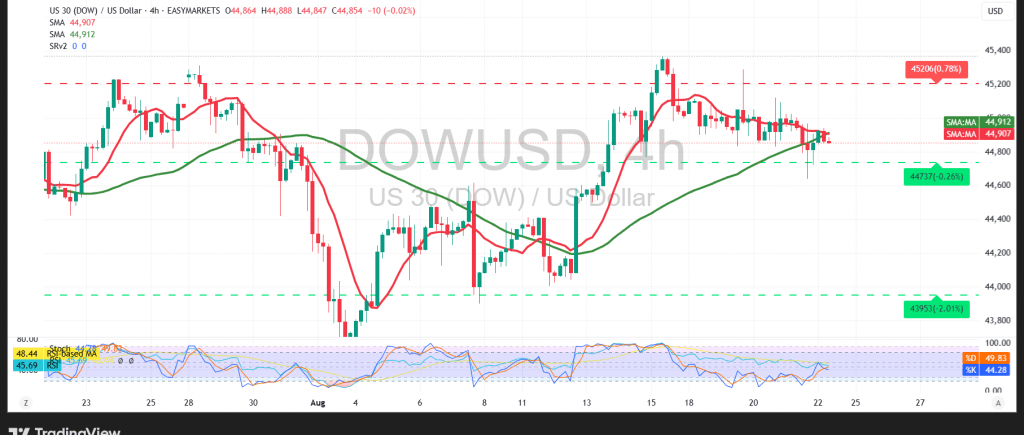

The Dow Jones Industrial Average (DJI30) saw mixed movements with a downward bias during the previous session after recording a high of 45004.

Technical Outlook – 4-Hour Timeframe

Technically, the 50-day Simple Moving Average has returned to exert pressure on the price from above. This is accompanied by negative signals from the Relative Strength Index (RSI), which is stable below the 50 midline. Furthermore, trading remains below the psychological barrier of 45000.

Probable Scenario

As long as the price remains stable below 45000 and, more importantly, 45030, we may see a decline in today’s session, targeting 44720. A break below this level could reinforce a further retreat toward 44660.

Conversely, a one-hour candle closing above the resistance level of 45030 would put the index back on an upward path with targets at 45195, followed by 45380.

Fundamental Note:

We are awaiting high-impact economic event today, namely “Jerome Powell’s speech at the Jackson Hole Economic Symposium throughout the day.” This event could cause strong price volatility.

Warning

The risk level is high amid current trade and geopolitical tensions, and all scenarios could be possible.

Disclaimer

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 44660 | R1: 44470 |

| S2: 44295 | R2: 45030 |

| S3: 45195 | R3: 45385 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations