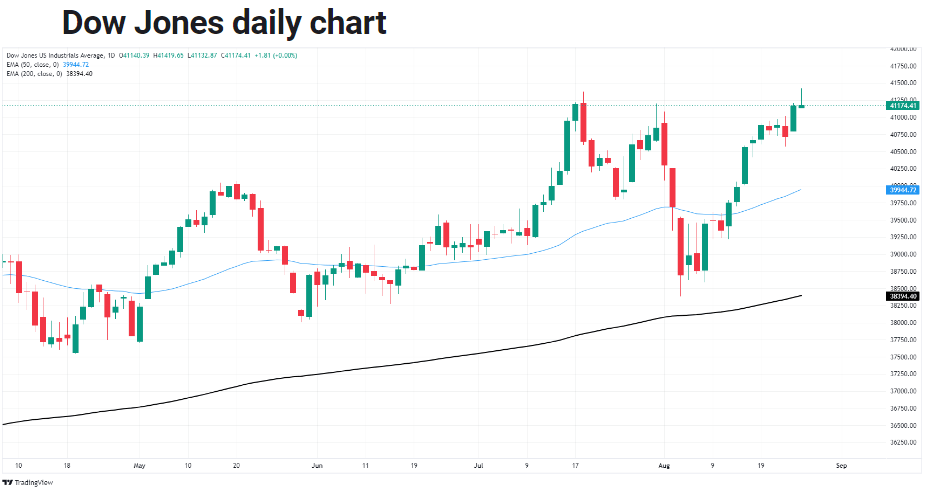

Dow Jones Industrial Average (DJIA) reached a new all-time high of 41,419.65 on Monday, despite a generally quiet trading day. This follows a significant surge last week after the Federal Reserve signaled a potential rate cut in September.

Investors are still digesting the impact of the Federal Reserve’s comments, which indicated a shift towards a more dovish monetary policy. The market’s upward movement was supported by relatively low trading volume, suggesting that the recent momentum may be fragile.

Economic Indicators and Market Outlook

The upcoming release of key economic indicators, such as Q2 GDP and July’s core PCE inflation, will be closely watched for clues about the Fed’s future rate decisions. A strong increase in July’s Durable Goods Orders provided a boost to manufacturing stocks, while the tech sector, which has been a major driver of the market’s recent performance, experienced a slight pullback on Monday.

Despite the positive news from the Durable Goods Orders, there are still concerns about the overall economic outlook. Excluding transportation spending, Durable Goods Orders actually contracted, indicating a weaker underlying trend.

Market Sentiment and Potential Pullback

While the Dow Jones has achieved a new peak, analysts caution that the current momentum may be unsustainable. The market is expected to experience a pullback as investors reassess the situation and await further economic data. The Dow Jones is poised for a relief pullback towards the 50-day Exponential Moving Average (EMA) at 39,946.29, which could provide a temporary support level.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations