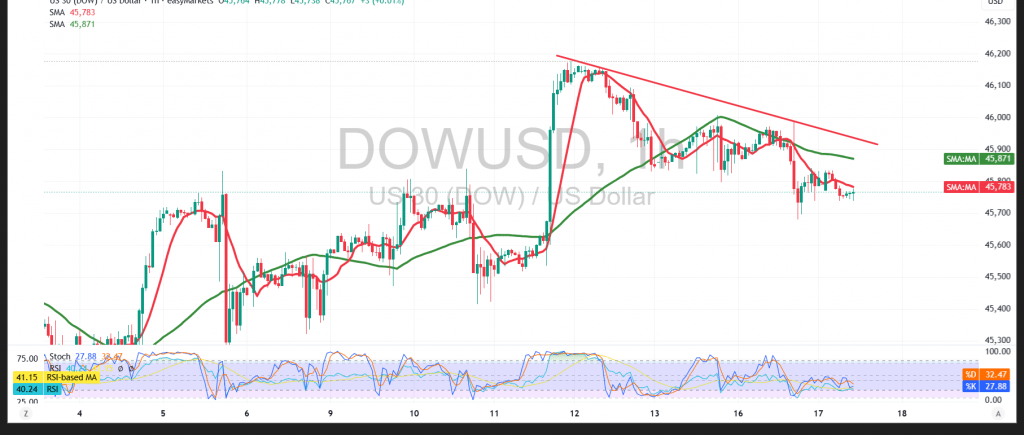

The index extended its gains in the previous session, recording a high near 45,990, but short-term indicators suggest cautious trading.

Technical Outlook:

- Moving Averages: The 50-period SMA is exerting slight downward pressure, hinting at potential short-term corrective moves.

- Momentum Indicators: The RSI is showing negative signals, reinforcing the likelihood of limited declines before any renewed upside attempts.

Probable Scenario:

- Bearish View: Continued consolidation below 45,860 may pressure the index toward 45,620 as the next support.

- Bullish View: A confirmed consolidation above 45,860 could allow recovery attempts toward 45,930, with further upside potential toward 46,120.

Market Alert: Today’s session carries high volatility risks with the release of key U.S. economic data (FOMC statement, Fed economic outlook, Chair Powell’s press conference, and the Fed Funds Rate).

Risk Warning: Geopolitical and trade tensions remain elevated, making all scenarios possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 45620 | R1: 45930 |

| S2: 45495 | R2: 46120 |

| S3: 45315 | R3: 46245 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations