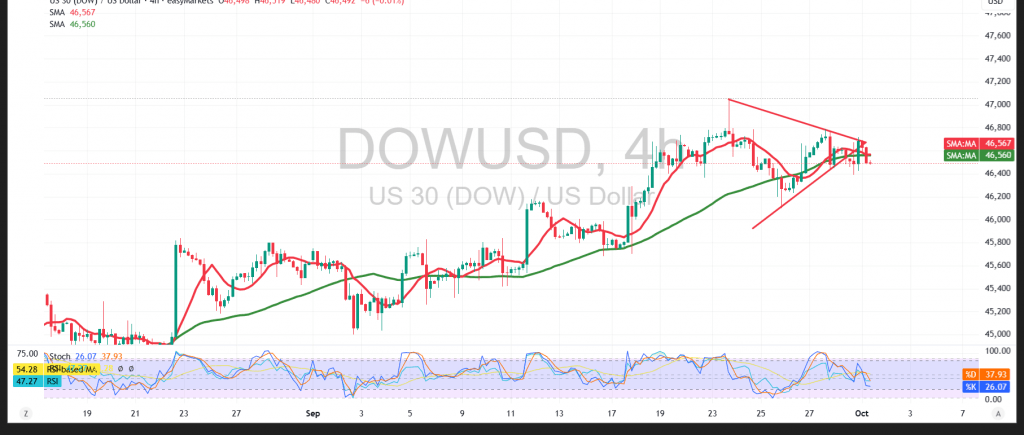

The index extended its downside move, in line with bearish expectations, touching the official target at 46,430 and recording a session low of 46,388.

Technical Outlook:

- 50-period SMA: Continues to act as dynamic resistance, reinforcing downward pressure.

- RSI: Sending negative signals, reflecting a gradual weakening of momentum.

Probable Scenario:

- Bearish Case: Stability below 46,680 keeps the index exposed to additional downside pressure, with targets at 46,350 and then 46,300.

- Bullish Case: A confirmed consolidation above 46,680 could shift momentum back upward, opening the way toward 46,860, with potential gains extending to 47,000.

Risk Warning: High volatility is expected with today’s US Nonfarm ADP and ISM Manufacturing PMI releases. Geopolitical and trade-related risks remain elevated, making all scenarios possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 46350 | R1: 46680 |

| S2: 46205 | R2: 46860 |

| S3: 46020 | R3: 47005 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations