The Dow Jones Industrial Average successfully reached its first upside target at 49,640, as outlined in the previous technical report, extending gains to a session high near 49,767.

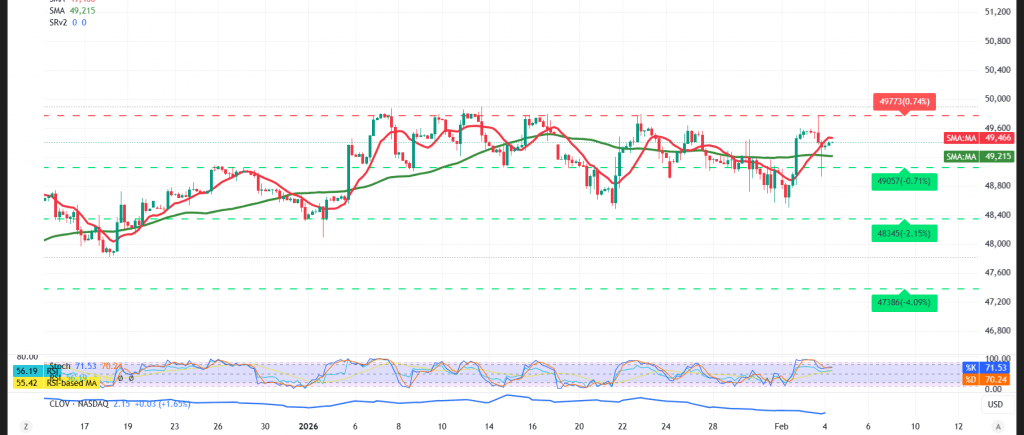

Technical Outlook – 4-Hour Chart

Price action remains supported above the simple moving averages, which continues to favor the broader recovery scenario. However, momentum indicators are starting to flash caution. The Relative Strength Index (RSI) has entered overbought territory and is beginning to issue negative signals, suggesting that upside momentum may be losing strength and that further gains could be limited in the near term.

Expected Scenario

If daily trading remains capped below the 49,480 resistance level, a corrective pullback becomes more likely, with an initial downside target near 48,975.

On the other hand, if price manages to hold above the 49,480 level, upside attempts could persist, potentially pushing the index toward 49,810.

Market Note:

High-impact U.S. economic data is due today, particularly the Non-Farm Payrolls (NFP) report and the ISM Services PMI. Elevated volatility is expected around the release.

Risk Warning:

Market conditions remain high-risk amid ongoing trade and geopolitical tensions, and all scenarios remain possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 48975 | R1: 49810 |

| S2: 48535 | R2: 50205 |

| S3: 48140 | R3: 50630 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations