The Dow Jones Industrial Average (DJIA) extended its gains on Wall Street, reaching a high of 48,131.

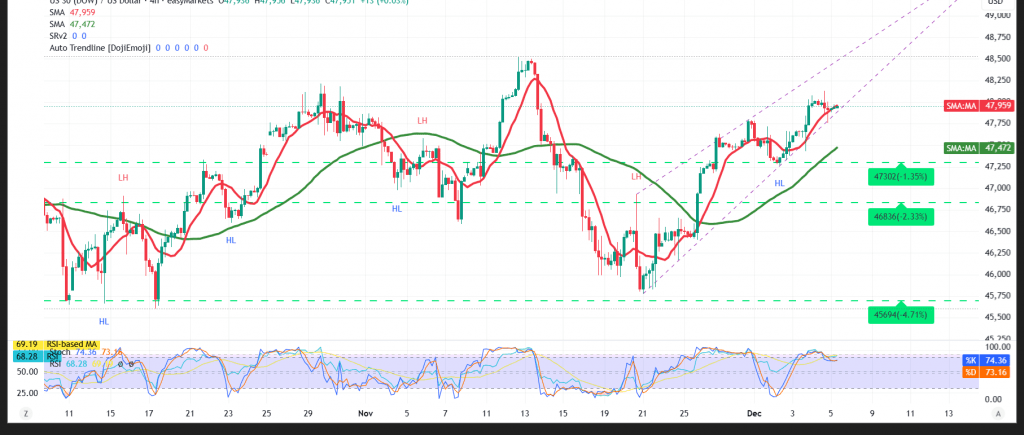

Technical Outlook – 4-Hour Timeframe:

The 50-period Simple Moving Average (SMA) continues to support the prevailing upward trend and provides additional positive momentum. The Relative Strength Index (RSI) is also delivering positive signals, indicating strength in the current upward movement.

Likely Scenario:

As long as daily trading holds above 47,750, the bullish outlook remains intact. A break above the 48,130 resistance level could allow the index to extend its gains toward the initial target of 48,320.

Conversely, a confirmed break below 47,750 would expose the index to direct downside pressure, with a potential move toward 47,580.

Caution: The risk level is high and may not be suitable for all investors.

Warning: Today we await highly significant U.S. economic data, including the core personal consumption expenditures (PCE) price index (monthly and annual) and the preliminary Michigan consumer sentiment index. High volatility is likely around the time of release.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 47765 | R1: 48135 |

| S2: 47580 | R2: 48320 |

| S3: 47390 | R3: 48510 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations