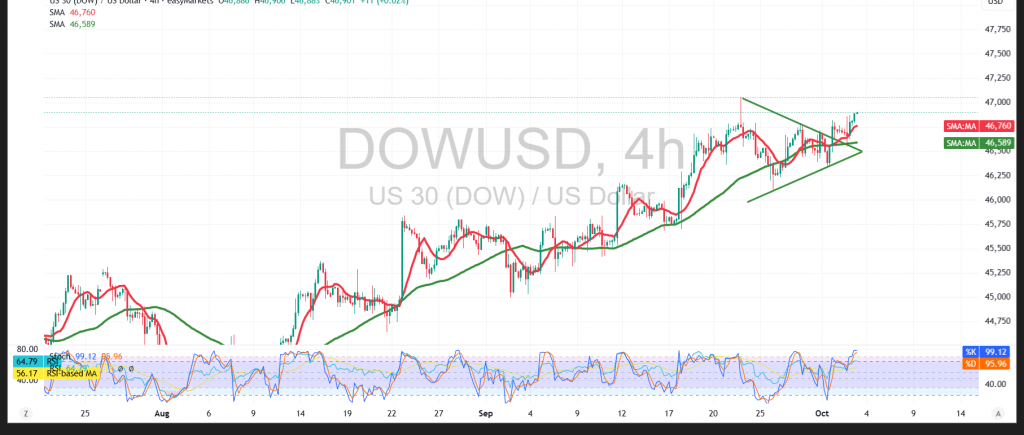

The index continues its advance on Wall Street, gradually approaching the 47,000 psychological barrier.

Technical Picture:

- 50-day SMA: Provides consistent support, reinforcing the prevailing bullish bias.

- RSI: Maintains positive signals on short-term timeframes, reflecting sustained upward momentum.

Probable Scenario:

- Bullish Case (preferred): As long as daily trading consolidates above 46,660, the outlook remains positive. A confirmed breakout above 46,910 could provide additional momentum, paving the way towards 47,020 and then 47,140.

- Bearish Case (alternative): A return to stable trading below 46,660 would weaken the bullish outlook and could trigger a decline toward 46,420 as the next support level.

Event Risk: Today’s focus is on US Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings. High volatility is expected upon release.

General Warning: The risk level remains high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 46660 | R1: 47020 |

| S2: 46420 | R2: 47145 |

| S3: 46295 | R3: 47380 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations