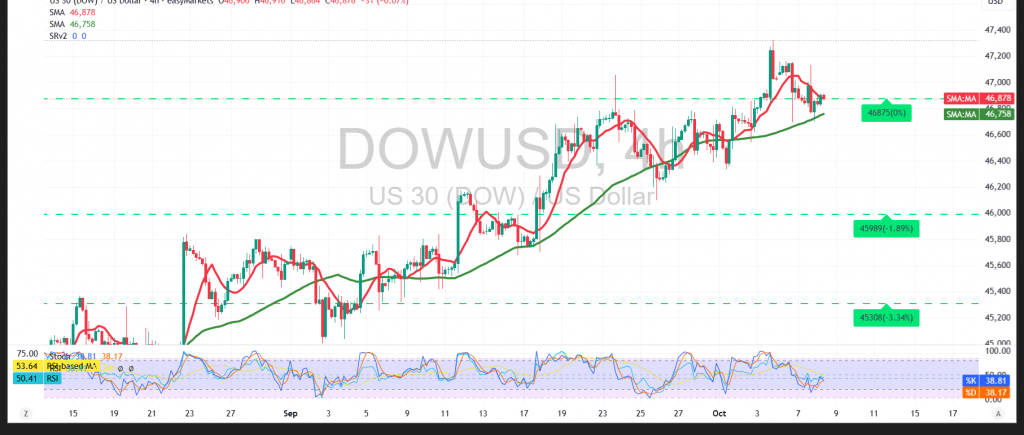

The Dow Jones Industrial Average (DJI30) saw mixed performance on Wall Street, retreating slightly after reaching a session high of 47,136, as investors booked profits following the recent bullish rally. Despite the pullback, the broader trend remains upward.

Technical Outlook – 4-Hour Timeframe:

The 50-day Simple Moving Average (SMA) continues to act as a supportive indicator, providing a positive bias that maintains the prevailing uptrend.

However, the Relative Strength Index (RSI) has started to issue short-term negative signals, suggesting that the index may face temporary consolidation or mild corrective movement before resuming its upward path.

Probable Scenario:

A limited downside move appears likely in the near term, particularly if intraday trading holds below the 46,960 resistance level. This could lead to a retest of 46,700, and possibly 46,670, before the index attempts another push higher.

Conversely, a decisive breakout above 47,105 would confirm renewed bullish momentum and open the way for further gains toward 47,340.

Warning:

Risk levels remain elevated, and potential returns may not justify exposure. Persistent trade and geopolitical uncertainties continue to amplify volatility, keeping all scenarios possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 46670 | R1: 47105 |

| S2: 46470 | R2: 47340 |

| S3: 46235 | R3: 47540 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations