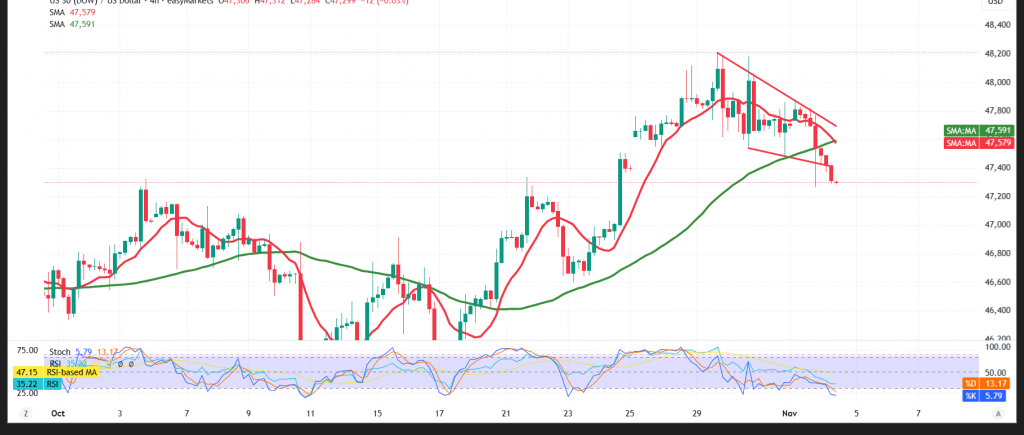

The index faded in the prior session after failing to confirm a breakout above 47,820, shifting the near-term bias to the downside.

Technical outlook

- 50-SMA (4H): Has rolled over above price and now acts as dynamic resistance.

- RSI: Turning lower with negative signals, though attempting to unwind oversold readings.

Base case (bearish while below 47,450)

- Maintaining trade below 47,450 keeps the downside favored.

- A decisive break/4H close under 47,265 would likely extend losses toward 47,110 initially.

Upside re-engagement

- Reclaiming and holding above 47,450 would revive bullish prospects, refocusing 47,670 and then 48,020.

Risk note

Volatility is elevated and may be disproportionate to potential returns. Use prudent sizing and firm stops; reassess quickly if these levels give way.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 47710 | R1: 47670 |

| S2: 46910 | R2: 48025 |

| S3: 46550 | R3: 48230 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations