The Dow Jones Industrial Average (DJI30) saw mixed movements in the previous trading session, attempting an upward rebound after hitting a low of 45,183.

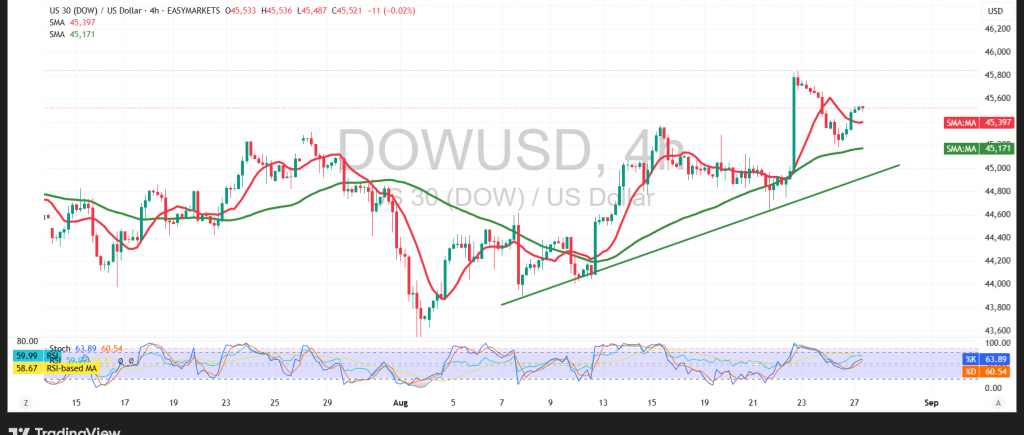

Technical Outlook – 4-hour timeframe:

The 50-period simple moving average has once again shifted to support the price from below, providing a positive technical signal. At the same time, the Relative Strength Index (RSI) is showing constructive signs, holding above the neutral 50 line and reinforcing the potential for further upward momentum.

Probable Scenario:

As long as the price remains above 45,330, the outlook favors a cautious upward trend, with targets at 45,645 as initial resistance and 45,770 as the next upside objective. Conversely, a confirmed one-hour close below 45,330 would place the index back under bearish pressure, opening the way for a move toward 45,290 and potentially 45,060.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 45290 | R1: 45645 |

| S2: 45060 | R2: 45770 |

| S3: 44935 | R3: 45995 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations